“Price is what you pay. Value is what you get.” ~ Warren Buffett

LAST post, I highlighted the importance of strategy when considering the viability of a potential acquisition; however, before a final decision can be made, a consultant needs to estimate the value of the target company.

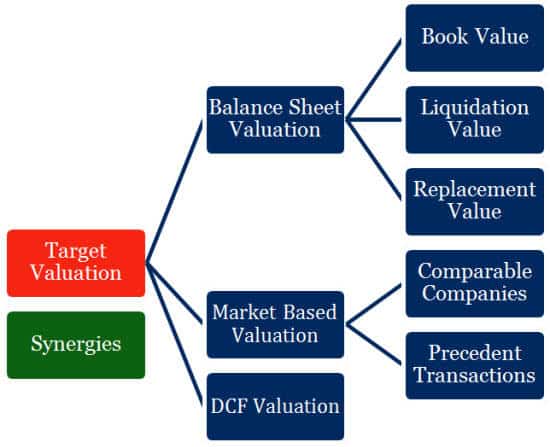

Building on information provided in Management Consulting: A Guide to the Profession, I highlight three approaches that a consultant can use when performing a valuation:

- Balance sheet valuation;

- Market based valuation; and

- Valuation of discounted expected future cash flows.

Each valuation method will result in a different estimate, and the method you select will depend on the situation.

If you are working for the target company, then the obvious goal is to choose the method that yields the highest possible valuation for the company.

However, if you are working for the acquiring company, then the valuation method you select depends on the objective for the merger. If the goal is diversification, then calculating the present value of future cash flows would be appropriate (DCF valuation). If on the other hand the company is being acquired for its resources and capabilities, then valuation should be based on either the market value or replacement value of assets. The replacement value is simply an estimate of how much it would cost to build similar resources and capabilities from scratch.

In addition to valuing the target company, you also need to estimate the value of potential synergies. Revenue synergies and cost synergies are the revenue streams and cost savings that would be available to a combined entity but not to the target or acquiring company acting by itself.

During a case interview, it is important to thoroughly explain your reasons for using a particular valuation method as well as describe the appropriate process for implementation.

🔴 Like this article?

Sharpen your edge in consulting