Before taking decisive action, it may be a good idea to assess the lay of the land

According to Sun Tzu, the quality of decision “is like the well-timed swoop of a falcon which enables it to strike and destroy its victim.”

And much like a circling falcon overhead, a company needs to take a 10,000 foot view of the business landscape before it can take swift and decisive action.

The framework outlined in this post provides a framework that business leaders can follow to examine the business situation.

1. Relevance

Having a framework to assess the business situation is relevant to any company in the context of making strategic decisions and, what’s more, every important decision that a company makes will in some way be strategic.

In the pursuit of growth, should a company enter a new market, develop a new product, launch a start-up, form a joint venture, or acquire a competitor? In a bid to cut costs, should a company reduce headcount, outsource production to a supplier, or utilize lower cost distribution channels? How should the company position itself within its industry?

In order to find answers to these key strategic questions, a company and its executives need to develop a clear understanding of the business landscape, and to do this it will help to have a simple framework to structure the exploration process.

2. Importance

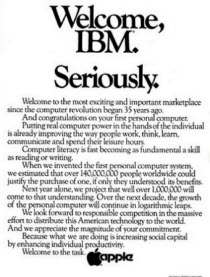

Failure to properly assess and understand the business landscape can have billion dollar implications and affect the course of an entire industry.

As part of the project, IBM made three surprising decisions:

- It allowed Microsoft the right to produce the operating system software and market it separately from the IBM PC;

- It chose to purchase the microprocessor from Intel; and

- It opted to make the IBM PC an “open architecture” product, publishing technical guides to the circuit designs and software source code.

These three strategic decisions helped to shift market power in the PC industry away from IBM and towards Microsoft and Intel.

Although the PC market grew quickly, companies like Compaq, Dell and HP soon reverse engineered the IBM PC and, since IBM had made it an open architecture product, they were able to sell a large number of clones, known as IBM compatibles, which increased the intensity of competition in the PC industry.

Meanwhile, booming PC sales from multiple vendors provided Microsoft and Intel with a lucrative and rapidly growing market for software and chips.

Despite the fact that IBM set the technology standard in the personal computer industry, it failed to capture the lion’s share of industry profits. It helped Microsoft and Intel establish lucrative markets for themselves, but was not itself able to compete in these markets due to high barriers to entry including technology patents, the Experience Curve effect and economies of scale.

IBM’s three strategic missteps were a blessing for Microsoft and Intel, which now have a combined market cap of over US$555 billion, but are an enduring sore point for IBM, which decided to jettison its PC business to Lenovo in 2005 for a mere $1.8 billion.

The story of the IBM PC is a cautionary tale. Companies that fail to assess the business landscape before taking action may find themselves in an untenable position.

3. Surveying the Business Landscape

A popular way to examine the competitive intensity and attractiveness of an industry is to use Porter’s Five Forces, a technique which was first outlined by HBS Professor Michael Porter in his 1979 book Competitive Strategy.

While the Porter’s five forces remains a useful reference point, and we incorporate its core elements into our framework, there is a bit of a problem with using it directly to assess the business landscape.

The key issue is that Porter’s Five Forces doesn’t consider the market power and unique characteristics of the company from whose perspective we are supposed to be analyzing the industry. For example, an industry may appear attractive from the perspective of a cash rich tech savy player like Google but appear quite unattractive to pretty much everyone else.

Through their strategies, firms have the ability to change industry structure, and so the business landscape will always need to be assessed relative to the market power of a particular organisation.

In order to assess the business landscape, we will examine the three entities whose market power, strategies and actions will, in any industry, have the capacity to affect a firm’s profitability: the customer, the competition and the company itself.

3.1 Understanding the Customer

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.” ~ Sam Walton, founder of Walmart

A good first step in assessing the business landscape is to examine the customer, the people whose problems the industry is trying to solve.

Below we outline eleven (11) factors to consider when examining the customer.

1. Identifying the customer

In general terms, who is the customer?

In trying to identify the customer, remember that the person who makes the purchase decision, the person who pays (the customer), and the end user (the consumer) may all be different people. For example, a doctor may prescribe medicine that will be used by a patient (the consumer) and paid for by an insurance company (the customer).

2. Placing customers into meaningful buckets

Dividing customers into meaningful groups can make it easier to understand their specific needs and preferences.

For example, it may make sense to group customers by:

- Age group

- Gender

- Income level

- Employment status

- Distribution channel

- Region

- Product preference

- New versus existing customers

- Large versus small customers

3. Size

How big is the market? How big is each customer segment? How many customers are there and what is the dollar value of those customers?

4. Growth

How fast is the market growing? What is the growth rate of each customer segment?

5. Industry Life Cycle

Where is the industry in its life cycle: early stage, growth, maturity or decline?

6. Customer Preferences

What do customers want? Do different customer segments want different things? Are the needs and preferences of customers changing over time?

7. Willingness to Pay

How much is each customer segment willing to pay?

How price sensitive is each customer segment? For example, students will normally be price sensitive, which means that offering student discounts can often increase quantity sold by enough to boost total revenues.

8. Concentration

What is the concentration of customers in the market relative to the concentration of firms? Is there a small handful of customers who are so large that they cannot be ignored?

If the market is dominated by a small number of large and powerful customers then it may be necessary to either play by their rules or search for a more favorable market (see Walmart Effect).

9. Recent and impending changes

Have there been any recent changes in the industry? Are there any impending changes? For example, M&A activity, new entrants, new substitutes, new technology, or changes in government policy.

10. Industry Drivers

What drives the industry: brand, product quality, scale of operations, or technology?

11. Distribution

What is the best way to reach customers (mail order, online store, factory outlet, retail store, supermarket, department store or network marketing)?

Does each customer segment have a preferred distribution channel? For example, younger customers may prefer purchasing online whereas older customers may prefer bricks and mortar retail outlets.

3.2 Understanding the Competition

“Competition is not only the basis of protection to the consumer, but is the incentive to progress.” ~ Herbert Hoover, 31st President of the United States

In order to understand the business landscape it is also important to understand the competition, and this can be done by examining horizontal competition (competition between firms at the same stage of production) and vertical competition (competition from within the supply chain).

3.2.1 Horizontal Competition

Competition can come from firms within the industry who are offering similar solutions to the same group of customers (e.g. Pepsi and Coca Cola).

Competition can also come from firms in other industries who produce substitutes. Substitutes may have quite different characteristics (for example, petroleum and natural gas) but they represent a form of indirect competition because consumers can use them in place of one another (at least in some circumstances). For example, petroleum and natural gas might both be used to produce heat and energy.

Below we outline ten (10) factors to consider when examining the competition.

1. Identifying direct competitors

Who are the company’s major competitors? Taking Cadbury as an example, some of its major competitors might include Lindt, Ferrero, Nestlé, Hershey’s and Mars. What products and services do they offer?

2. Substitutes

Who are the company’s indirect competitors? That is, which firms are producing substitutes?

To identify these, it helps to take a broader view of what the company offers. For example, Cadbury sells chocolate, but more broadly it might be thought of as a snack food company, and so indirect competitors might include companies like Lays, Cheetos and Doritos.

3. Placing the competition into meaningful buckets

Is it possible to group competitors in a meaningful way? The competition might be categorized by distribution channel, region, product line, or customer segment. For example, the FOX Broadcasting Company might segment the competition by region. In America, some of its major competitors include PBS, NBC, CBS and ABC. While in Australia, competitors include Channel 7, 9 and 10 as well as ABC and SBS.

4. Size and Concentration

What is the sales volume and market share of major competitors?

What is the concentration of competitors in the industry? That is, are there lots of small competitors (a low concentration industry) or a few dominant players (high concentration industry)? Examples of high concentration industries include oil, tobacco and soft drinks. Examples of low concentration industries include wheat and corn.

5. Performance

What is the historical performance of the competition? Relevant indicators of performance might include profit margins, net income, and return on investment.

6. Competitive Advantage

What is the competition good at? How sustainable are these advantages?

What are their weaknesses? How easily might these weaknesses be exploited?

7. Competitive Strategy

What competitive strategy is the competition pursuing? Do they produce products that are low cost or differentiated? Which market segments do they target?

What is the competition’s pricing strategy, distribution strategy and growth strategy? (see Product/Market Expansion Matrix).

8. Competitive Balance

Is the industry balanced in the sense that competitors have clear and sustainable positions within the industry? This might be the case where firms have taken efforts to differentiate themselves by providing customers with different value propositions which appeal to different consumer preferences.

On the one hand, the industry may be unbalanced where multiple competitors are trying to become the low cost firm within the industry resulting in aggressive price competition and the destruction of industry profitability. Similarly, the industry may be unbalanced by a distant follower who is making aggressive moves in an attempt to improve its position, for example by introducing low priced unbranded generic products.

9. Competitive Response

How will the competition respond to the company’s actions?

10. Barriers to entry

The threat posed by potential competition depends on the level of barriers to entry. Barriers to entry make it more difficult for potential competitors to enter, and allow existing firms to maintain higher prices than would otherwise be possible.

3.2.2 Vertical Competition

Competition includes not just other firms operating at the same stage of production but any entities that have the potential to solve all or part of the end user’s problem, and thereby compete for a share of industry profits. This naturally includes vertical competition from suppliers and customers within the supply chain.

It is important and somewhat interesting to realise that suppliers and customers can represent a form of competition. Customers and suppliers within the supply chain that have more bargaining power will be able to extract a larger share of industry profits.

IBM learned about supplier bargaining power the hard way when it helped Microsoft and Intel gain virtual monopolies over the supply of key components for the personal computer.

Factors that will affect the bargaining power of suppliers (e.g. Microsoft and Intel) include:

- The number of available suppliers and the strength of competition between them;

- Whether suppliers produce homogenous or differentiated products;

- The brand recognition of a supplier and its products;

- The importance of sales volume to the supplier;

- The cost to the firm of switching suppliers;

- The availability of substitutes; and

- The threat of forward integration by the supplier relative to the threat of backward integration by firms in the industry.

Amazon.com has gained substantial customer bargaining power in the publishing industry due to the huge volume of books that it is able to sell and distribute.

Factors that will affect the bargaining power of customers (e.g. Amazon) include:

- The number of customers;

- The volume a customer demands relative to a firm’s total output;

- The availability of substitutes;

- The cost to the customer of switching products or firms;

- The availability of product comparison information; and

- The threat of backward integration by the customer relative to the threat of forwards integration by firms in the industry.

3.2.3 Competitive Intensity

Below we outline twelve (12) factors that will influence the strength of competition within an industry:

- Number of firms: The more firms there are in an industry the stronger will be the competitive rivalry since there will be more firms competing to serve the same number of customers;

- Market growth: If the market growth rate slows then this will increase competition since firms will need to compete more aggressively to gain new customers;

- Economies of scale: If firms in the industry have relatively high fixed costs and low variable costs then this will lead to more intense rivalry as firms compete to gain market share;

- Excess capacity: If the industry experiences cyclical demand then this may result in sporadic industry wide excess capacity leading to bouts of intense price competition;

- Switching costs: If customers have low switching costs, then this will intensify competition as firms compete to retain existing customers and steal customers from the competition;

- Product differentiation: If firms in an industry produce homogeneous products, then firms will be forced to compete on price. Firms can achieve product differentiation in various ways including improving product quality, features, branding and availability;

- Instability: Diversity of competition (for example, firms from different countries or cultures) may reduce predictability within a market and lead firms to compete more aggressively;

- Entry barriers: Low entry barriers will allow more competitors to enter the market resulting in more intense competitive rivalry (see ‘Barriers to entry‘);

- Exit barriers: High exit barriers will increase competition because firms that might otherwise exit an industry are forced to stay and compete. A common exit barrier is where a firm has highly specialized equipment that it cannot sell or use for any other purpose;

- Industry shakeout: Where a growing market induces a large number of firms to enter, a point is likely to be reached where the industry becomes crowded. When market growth slows, a period of intense competition, price wars and company failures is likely to ensue;

- Substitutes: If the number of substitutes increases, the relative price performance of substitutes improve, the prices of substitutes decrease, or customer willingness to substitute increases, then this will increase the intensity of rivalry within an industry as firms compete more intensely to retain customers; and

- Bargaining power of suppliers and customers: If suppliers and customers have more bargaining power then they will be able to extract a larger share of industry profits. This will reduce the profitability of firms in the industry, which may result in more intense competition, industry consolidation, vertical integration, and company failures.

3.3 Understanding the Company

“Know your enemy and know yourself and you can fight a hundred battles without disaster.” ~ Sun Tzu

In assessing the business landscape, it is not enough simply to understand the customer and the competition, it is also important to understand the organisation from whose perspective we are analyzing the industry.

Below we outline ten (10) factors to consider when examining the company.

1. Performance

What is the historical performance of the company? How does this compare to the competition? If profits have declined, what is the source of the decrease? Is it a cause for concern? (see the Profitability Framework).

2. Competitive Advantage

What are the company’s capabilities and key strengths? How sustainable are these advantages? What are its weaknesses and can these be remedied?

3. Competitive Strategy

What is the company’s competitive strategy? Does the company focus on reducing costs or on differentiating itself in a way that customers value? Which market segments does the company target? (see Porter’s Generic Strategies).

4. Products

What does the company offer and how does this benefit customers?

Is the product a commodity or differentiated?

How does the company’s offering compare with the competition?

Where does the product fall within its product lifecycle? (see Product Life Cycle Model)

What is bundled with the product, for example, customer service, warranty insurance or more hard disk space? Are there opportunities to bundle or unbundle the product in order to increase sales?

5. Finances

If the company is considering a certain course of action, does it have sufficient funds available to undertake the project? Financing may be sourced from internal cash reserves, bank loans, shareholder loans, bond issues or sale of shares.

How many units will need to be sold in order to recover the total project cost? Is there sufficient market demand?

6. Cost Structure

It may be obvious from a company’s profit and loss statement whether it is a high cost or a low cost operator, however aggregate figures can often hide important details.

In order to understand a company’s cost structure, it will help to break each business unit down into the collection of activities that are performed to design, produce, market, deliver and support its product. The way each activity is performed combined with its economics will determine a firm’s relative cost structure within its industry. This technique for examining a company’s cost structure is an application of Value Chain Analysis.

7. Organisational Cohesiveness

Understanding a firm’s inner workings is important since competitive strategies can fail if they conflict with a firm’s culture, systems and general way of doing business. The organisational aspects of a firm can be examined using the Seven S Framework.

8. Marketing

How do the company communicate with customers, and how do customers perceive the company and its products?

9. Distribution Channels

What distribution channels does the company use to reach customers? Are there other distribution channels that are more cost effective or which are preferred by customers?

10. Customer Service

Are employees empowered to solve problems and delight individual customers?

For more information on consulting concepts and frameworks, please download “The Little Blue Consulting Handbook“.

Image: Flickr