(Source: Flickr)

In this post we outline some mathematical concepts that may prove useful for solving consulting case questions.

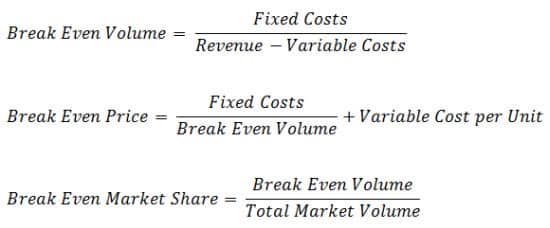

1. Break Even Analysis:

Relevant when trying to decide whether to launch a new product or invest in a project with high fixed costs.

2. Customer Lifetime Value:

Customer lifetime value is a prediction of the entire future value that a company expects to derive from its relationship with a customer. It is a useful tool for a company that is trying to decide which customer segments to target and how much to spend on customer acquisition.

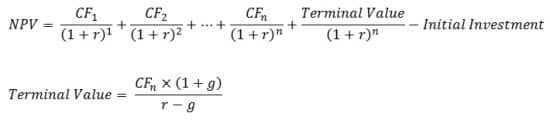

3. Net Present Value:

The NPV of an investment is the present value of the series of expected future cash flows generated by the investment minus the cost of the initial investment.

Where r = discount rate; CFt = expected cash flow in year t; CFn = expected cash flow in final year; g = long term cash flow growth rate.

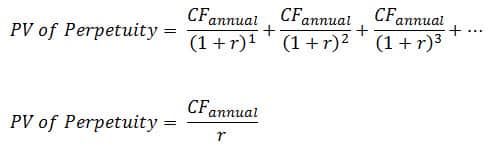

4. Perpetuity:

A perpetuity is a constant stream of identical cash flows with no end.

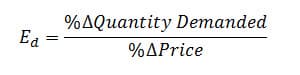

5. Price elasticity of demand:

Price elasticity of demand is a measure of the responsiveness of quantity demanded to a change in price, and is relevant when formulating pricing strategy.

If demand is elastic (Ed > 1) then changes in price will have a relatively large effect on the quantity demanded, and total revenue will rise if prices are lowered.

If demand is inelastic (Ed < 1) then changes in price will have a relatively small effect on the quantity demanded, and total revenue will rise if prices are raised.

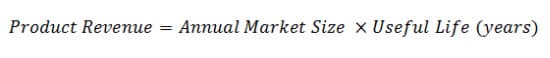

6. Product life cycle:

The product life cycle is relevant when calculating the expected lifetime revenue of a product.

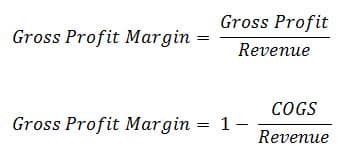

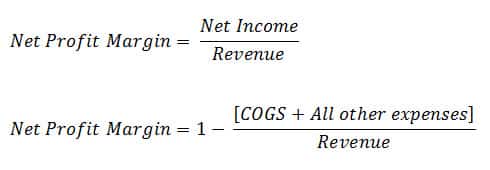

7. Profit Margin:

Gross Profit Margin: Gross profit margin measures how much of every dollar of sales revenue remains after subtracting the cost of goods sold.

Net Profit Margin: Net profit margin measures how much out of every dollar of sales revenue a company actually keeps. Net profit margin is useful when comparing companies in similar industries. A higher net profit margin indicates a more profitable company that has better control over its costs compared to its competitors.

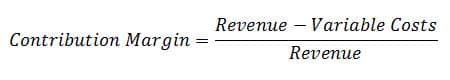

Contribution Margin: A cost accounting concept that allows a company to determine the profitability of individual products.

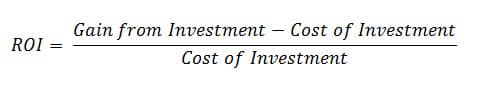

8. Return on Investment:

ROI is a performance measure that a company can use to evaluate the efficiency of an investment or to compare a number of different investments.

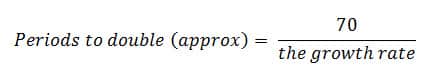

9. Rule of 70:

The Rule of 70 is a simple rule of thumb that can be used to figure out roughly how long it will take for an investment to double, given an expected growth rate.

The rule can be described by the following equation:

[For more information on the consulting interview, download “The HUB’s Guide to the Consulting Interview“.]