The Three C’s Framework may prove extremely valuable for consulting case questions.

It can help to assess the business situation in the context of entering a new market, M&A, product development, and starting a new business.

It involves examining customers, competition, and the company.

1. Customers

Eight (8) factors to consider when examining the customer.

1. Customer Identification

In general terms, who is the customer?

In trying to identify the customer, remember that the person who makes the purchase decision, the person who pays (the customer), and the end user may all be different people. For example, a doctor may prescribe medicine, paid for by an insurance company, and used by the patient.

2. Customer Segmentation

Customer segmentation can make it easier to understand customer needs and preferences, and the size and growth rate of different revenue streams.

It may make sense to segment customers by:

- Age group;

- Gender;

- Income level;

- Employment status;

- Distribution channel;

- Region;

- Product or product line;

- New versus existing customers; or

- Large versus small customers.

3. Size

How big is the market? How big is each customer segment?

4. Growth

How fast is the market growing? What is the growth rate of each customer segment?

5. Customer Preferences

What do customers want? Do different customer segments want different things? Are the needs and preferences of customers changing over time?

6. Willingness to Pay

How much is each customer segment willing to pay?

How price sensitive is each customer segment?

7. Bargaining Power

What is the concentration of customers in the market relative to the concentration of firms?

Do customers face high switching costs?

8. Distribution

What is the best way to reach customers (mail order, online store, factory outlet, retail store, supermarket, department stores, or network marketing)? Does each customer segment have a preferred distribution channel?

2. Competition

Competition can come from firms within an industry, or from firms in other industries who produce substitutes.

Competition can also come from suppliers and customers within the supply chain who exert bargaining power to extract a larger share of industry profits.

Eleven (11) factors to consider when examining the competition.

1. Competitor Identification

Who are the company’s major competitors? What products and services do they offer?

Who are the company’s indirect competitors? That is, which firms are producing substitutes?

2. Competitor Segmentation

Is it possible to segment the competition? This might be done by distribution channel, region, product line, or customer segment.

3. Size and Concentration

What are the revenues and market shares of major competitors? What is the concentration of competitors in the industry?

4. Performance

What is the historical performance of the competition? Relevant performance metrics might include profit margins, net income, and return on investment.

5. Industry Lifecycle

Where is the industry in its lifecycle? Early stage, growth, maturity or decline?

6. Industry Drivers

What drives the industry: brand, product quality, scale, or technology?

7. Competitive Advantage

What is the competition good at? How sustainable are these advantages?

What are their weaknesses? How easily can these weaknesses be exploited?

8. Competitive Strategy

What competitive strategy is the competition pursuing? Is the competition producing products that are low cost or differentiated? What customer segments is the competition targeting?

What is the competition’s pricing strategy, distribution strategy and growth strategy?

9. Barriers to Entry

The threat posed by potential competitors depends on the level of barriers to entry.

Barriers to entry make it more difficult for potential competitors to enter, and so reduces competitive rivalry and allows existing firms to maintain higher prices than would otherwise be possible.

Key barriers to entry might include capital requirements, economies of scale, network effects, government policy, switching costs, access to suppliers, access to distribution channels, product differentiation, and proprietary product technology.

10. Supplier bargaining power

Factors that affect the bargaining power of suppliers might include:

- The number of available suppliers and the strength of competition between them;

- Whether suppliers produce homogenous or differentiated products;

- The brand recognition of a supplier and its products;

- The importance of sales volume to the supplier;

- The cost to the firm of switching suppliers;

- The availability of supplier substitutes; and

- The threat of forward integration by the supplier relative to the threat of backward integration by firms in the industry.

11. Customer bargaining power

Factors that affect the bargaining power of customers might include:

- The number of customers;

- The volume a customer demands relative to a firm’s total output;

- The availability of substitutes;

- Customer switching costs;

- Access to product comparison information; and

- The threat of backward integration by the customer relative to the threat of forwards integration by firms in the industry.

3. Company

Ten (10) factors to consider when examining the company.

1. Performance

What is the historical performance of the company? What is its market share?

2. Competitive Advantage

What are the company’s resources and capabilities? How sustainable are the company’s advantages? What are the company’s weaknesses and can they be remedied?

3. Competitive Strategy

What is the company’s competitive strategy? Does the company focus on producing products that are low cost or differentiated? Which customer segments does the company target?

4. Products

What does the company offer and how does it benefit customers? Does the product have any downsides or side effects?

Is the product a commodity or differentiated?

How does the company’s product offering compare with the competition? Are there substitutes available?

Where does the product fall within its product lifecycle?

What is bundled with the product? For example, customer service, warranties, or spare parts. Are there opportunities to bundle or unbundle the product in order to increase sales volume?

5. Finances

If the company is considering a certain course of action, does it have sufficient funds available to undertake the project? What’s the break even analysis?

6. Cost Structure

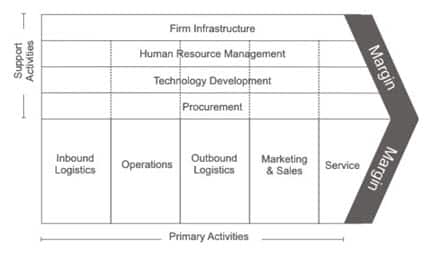

Consider the cost structure of the business. This can be done by segmenting costs into value chain activities: inbound logistics, operations, outbound logistics, sales & marketing, customer service.

Consider also fixed costs and variable costs. Have there been any significant changes in the company’s cost drivers? How do costs compare to the competition?

7. Organisational Cohesiveness

Understanding a company’s inner workings can be important since competitive strategies can fail if they conflict with a firm’s general way of doing business. Analysing the inner workings of an organisation can be done by using the McKinsey 7 S Model.

8. Marketing

What does the company stand for? How do customers perceive the company and its products? How does the company communicate with customers?

9. Distribution Channels

What distribution channels does the company use to reach customers (mail order, online store, factory outlet, retail store, supermarket, department stores, or network marketing)?

10. Customer Service

How does the company interact with and support customers? Does the company have a customer loyalty program?

For more information on consulting interviews, please download “The HUB’s Guide to Consulting Interviews“.

Image: Flickr

🔴 Like this article?

Sharpen your edge in consulting