While it may not be a core framework for solving consulting case questions, the BCG Growth Share Matrix can help to broaden your understanding of how a company might want to allocate cash between products and business units.

The framework is based on the idea that the amount of cash a product uses is proportional to the rate of growth of that product in the market, and the generation of cash is a function of market share.

To be successful, the story goes, a company should have a portfolio of products with different growth rates and different market shares. Money generated from high-market-share products can then be used to develop high-growth products.

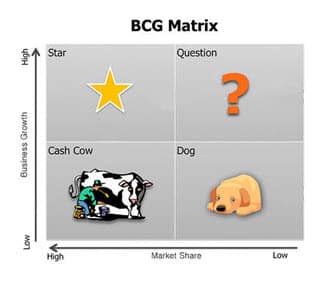

Under the BCG matrix, products are classified into four types:

- Stars are leaders in high growth markets. Stars grow rapidly and therefore use large amounts of cash. Stars also have a high market share and therefore generate large amounts of cash.

- Cash Cows are highly profitable and require low investment because they are market leaders in a low-growth market.

- Question Marks are low market share high growth products, and almost always require more cash than they can generate.

- Dogs are low market share low growth products. BCG refers to these products as “cash traps”. They require little cash but also generate little cash.

For more information on consulting interviews, please download “The HUB’s Guide to Consulting Interviews“.

Source: Flickr