Before we dive into why AI is the solution for the banking sector, let’s first explore what big tech companies have in common, how many of them have grown successfully, and what banks can learn.

The three ingredients that have contributed to the massive success of big tech firms might be described as:

- Identify big problems faced by customers

- Create scalable solutions

- Generate flywheel momentum to sustain growth

Taking Uber as an example, the company first identified expensive taxi/limo fares (problem) and aimed to use a GPS enabled smart phone app to connect drivers with riders more efficiently (solution). The company subsequently evolved to address a broader range of problems, including the high cost of owning a family car, by offering a cheap transportation alternative and introducing new solutions such as the meal delivery service “UberEats”. Starting with a focused service, transporting people from A to B, the solutions offered became broader over time. Finally, Uber appears to have created flywheel momentum by relentlessly improving its solutions with data and algorithms, attracting more traffic to the app, leading to more customers being served, allowing Uber to collect still more data and further improve its algorithms. Ultimately, this ensures a good customer experience, repeat visits, and greater share of wallet.

Learning from the experience of Uber and other tech firms, it appears that the paradigm has shifted from products to solutions, from product selling to problem solving. Furthermore, customers are increasingly expecting from banks much more value per dollar, better service, and seamless experiences regardless of channel.

Defining AI

Artificial intelligence (AI) refers to the autonomous intelligent behaviour of software or machines that have a human-like ability to make decisions and to improve over time by learning from experience. For convenience, it might be grouped into three application domains:

- Automation: Systems with domain-specific expertise that can automate related tasks (e.g. note taking by speech recognition).

- Engagement: Systems that analyze unstructured text, image, and video data to offer customized solutions (e.g. ChatBot).

- Insights: Systems that extract relationships and patterns from data to generate entirely new ideas and solutions.

Usage of AI in the Banking Sector

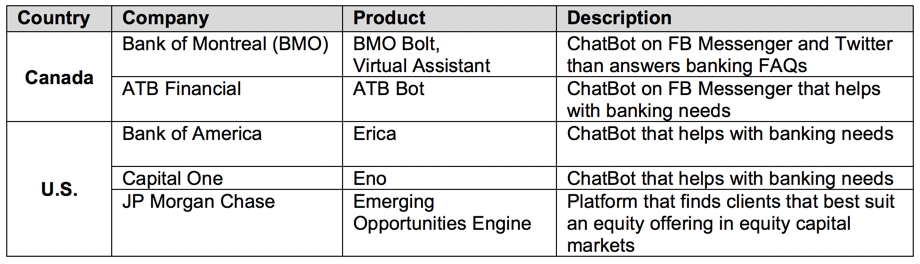

Table 1: AI applications across Canadian and US banks (Source: Financial Post, Techemergence)

As shown in the table above, the main usage of AI by banks across Canada and U.S. is to provide customer service chatbots. Financial services firms are taking steps to provide more personalized and responsive services to customers online across all channels: mobile apps, tablets, laptops, and desktop.

Why AI is the Solution

In order to try and understand why AI is the solution for banking, let’s go back to what we learned from the Uber example, and tie AI with the three ingredients for success.

1. Identify big problems faced by customers

While many banks have introduced new technologies, they have done so partly to increase efficiencies, reduce headcount, and save costs. Banks need to focus more seriously on identifying the key problems faced by customers.

In the previous post, we identified that one of the unmet needs of customers is their need for advice about their available budget and guidance about spending. Accordingly, RBC recently launched an app called NOMI, which uses AI to analyze and optimize a customer’s spending patterns. The output is a customized financial insight into personal banking and directions into saving money, and (according to RBC) has made the RBC Mobile app the most used money management platform in Canada.

2. Create scalable solutions

In a survey conducted with people who have less than $100,000 in investable assets (this represents up to 85% of consumers in North America and Europe), more than half indicated that they would be willing to try a product that provides advice about income and consumption choices.

AI, though still in its early stages of development, clearly has the potential to evolve into an advisory role, and help to solve unmet customer needs.

Many firms are currently working hard to develop robo-advisors, which can automatically build investment portfolios and give personalized investment recommendations. For example, China Merchants Bank, China’s largest non-state backed lender, launched such a product called “Machine Gene Investment” in December 2016, which now has more than RMB 10 billion AUM. Robo-advisors offer financial service firms the potential to service more customers, provide more customized investment recommendations, and operate the service at effectively zero marginal cost – a truly scalable solution. So much so, that we might ultimately expect a small number of massive robo-advisory firms to completely dominate this market. The race is on!

3. Generate flywheel momentum to sustain growth

AI systems become more accurate over time since they can learn from experience. AI can provide deep, actionable insights based not only on existing knowledge but also based on recognizing patterns in the data in order to predict what is likely to happen next. To achieve flywheel momentum, large volumes of data are currently required in order to train the AI system.

Financial services firms who can attract the most customers to their AI based solutions will be able to collect more data, and thereby accrue more knowledge and experience. This means that market share is crucially important. Financial services firms will need to focus on marketing, holding workshops and info sessions, and defining AI solutions in simple terms to make them more appealing and user-friendly. This will help to earn customer’s trust and increase the number of people who are willing to become users of this new solution. The increased usage will enable firms to obtain more data, which will be used to refine and further develop the technology.

Conclusion

Digital transformation is necessary for banks not only because of the need to reduce costs, but also because it offers the potential to address unmet customer needs, improve quality, and offer a better more responsive user experience. With AI, financial services firms can redesign solutions to focus on customer satisfaction. Some of the financial services firms are already doing this to find scalable solutions for major customer problems. In order to sustain this growth, the banking sector will need to move quickly to create flywheel momentum by educating customers and increasing their user base.

Jason Oh is a management consulting enthusiast with past experience in helping F500 financial services clients with product management, go-to-market and distribution channel strategy.

Image: Pexels