The financial services industry has seen drastic technology-driven change over the past few years, and digital has fundamentally reshaped consumer behaviour in banking. According to Oliver Wyman, a global management consulting firm, 90% of Canadian banking customers use digital channels and more than 30% are now banking exclusively virtually. In response, banks worldwide are making large investments in digital technology and analytics in order to:

- deliver a better experience,

- reduce costs,

- deepen and broaden existing client relationships,

- extend their distribution reach, and

- protect relationships against traditional and new competitors.

However, customer expectations are high and it is difficult for banks to decide which technologies to focus on. In PwC’s Global CEO survey, 70% of leaders in financial services highlighted speed of technological change as one of the biggest concerns. Moreover, traditional banks are facing challenges from tech firms as they start to offer banking-like services such as Amazon Cash, Paypal, and MYbank (owned by Alibaba). To survive and stand out in this rapidly changing landscape, banks need to embrace new technologies, and that includes AI.

Customer Value Gap

Two important questions that banks need to ask themselves are:

- How much value are financial services solutions delivering to customers?

- How could new value be created?

Historically, financial services products were designed for a world of greater certainty and less choice. In this context, they provided accessible deposits, savings, loans, and insurance – with relatively limited need to give advice. These traditional products have value. However, as the landscape changes, the value of these products has diminished.

We can understand how this is happening by looking at two figures from Oliver Wyman’s report.

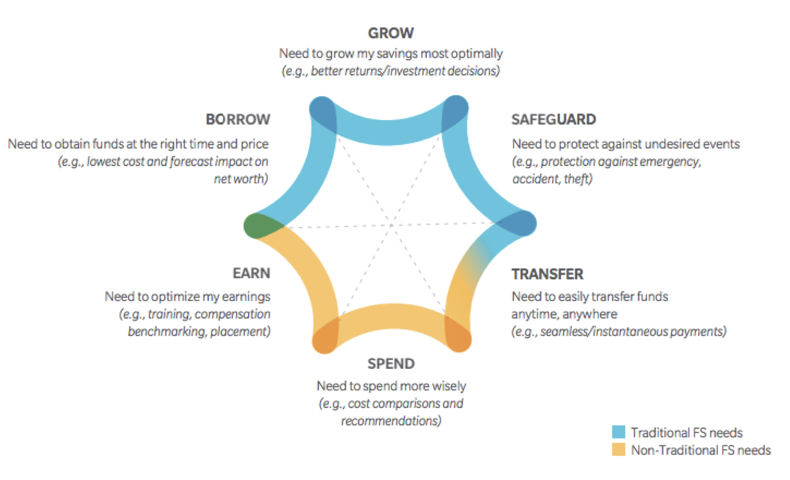

Figure 1: Financial Needs Hexagon (Oliver Wyman)

In Figure 1, we observe that traditional financial services firms fulfill the needs of lending, savings accounts, and insurance. However, there is a growing discrepancy between what the banks offer and what customers want.

In Figure 2, which illustrates the top 5 global financial needs for the mass market, the majority of customers rated receiving the best possible price on essential goods as a relevant need, followed by having a consistent income on a weekly/monthly basis. Clearly, neither of these are provided by legacy financial services firms. This helps to explain why other industries have started offering banking-like services and why we have witnessed such spectacular growth in fintech.

What can the banks do?

This dynamic is both an opportunity and a threat for traditional financial services firms.

Banks that can pivot their business to fulfill these needs have the opportunity to provide solutions to help customers manage their income and consumption choices and to more easily transfer funds. In this case, the opportunity is enormous, and they are in a good position to access it.

However, if these traditional firms see their business as providing mortgages, savings accounts, insurance policies, and credit cards, then the future is much more limited. The markets for these products are mature and there are many competitors.

More importantly, traditional banks should not be so naïve as to expect large technology firms to limit themselves to the non-traditional parts of the financial needs hexagon.

How much value are financial services solutions delivering to customers? And, how can new value be created?

Answering these two essential questions should ultimately point banks to focus on fulfilling customer needs.

In the next post, we will explore why AI offers a promising way for banks to fulfill the financial services needs of their customers.

Jason Oh is a management consulting enthusiast with past experience in helping F500 financial services clients with product management, go-to-market and distribution channel strategy.

Image: Pexels