In a mere two decades, China has become Africa’s biggest economic partner, surpassing the United States and EU member states. This is driven by China’s increasing participation in the global economy. According to a McKinsey report, China is one of the top economic partners for Africa across five dimensions: trade, level of foreign direct investment (FDI), growth of FDI, infrastructure financing, and aid. No other country matches this depth and breadth of engagement.

China’s engagement in Africa has the potential to bring capital investment as well as transfers of knowledge, skills, and technology. However, its growing role has drawn criticism. Some commentators claim that China is only in Africa to extract natural resources, acquire strategic infrastructure, and that transfers of human capital and technology are limited since Chinese firms mainly employ Chinese workers rather than local labour. Chinese firms have also been criticized for their willingness to work with autocratic regimes in Sudan, Angola and Zimbabwe.

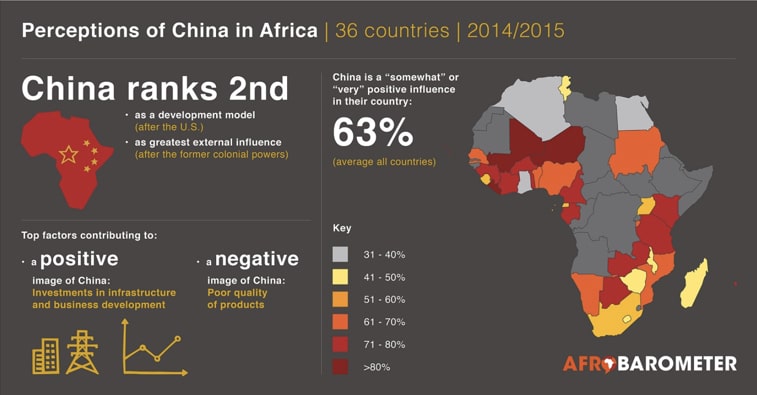

In assessing African perceptions of China an important consideration would be to examine how Africans view Chinese influence in their countries. According to a survey of 36 African countries conducted by Afrobarometer, the majority of Africans hold favourable views of China’s economic and developmental activities.

An interesting finding from this study was that Africans rank China alongside the USA as having a top development model for their countries. These perceptions not only emphasize the significance of China’s role in Africa, but also highlight the influence that China has in African states. Unfortunately, the true extent of the Africa-China economic relationship has been poorly understood because the data in the field is patchy and often inaccurate.

Below I consider three of the ways in which China is involved in Africa.

1. China as source of FDI

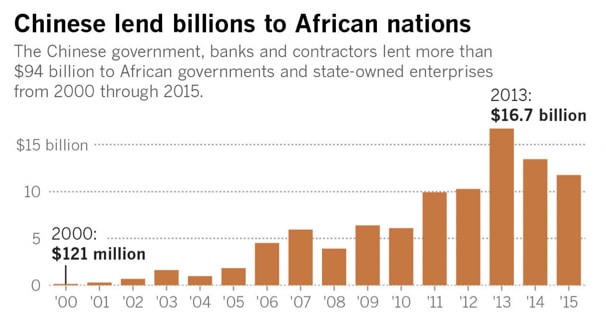

There is little transparency in the financial disbursements from China to Africa. While there is no publicly available breakdown of aid to individual countries, it is clear that FDI flows from China have been increasing exponentially since 2000, a year which saw the launch of the Forum on China-Africa Cooperation (FOCAC), the main institutional expression of the relationship between China and Africa. More than $94 billion was invested in Africa from 2000 to 2015.

In contrast to Western donors such as the European Union and the United States, which provide aid primarily in the form of grants, Chinese aid is heavily centred on concessional loans for infrastructure and export credits. This has increased the scrutiny of Chinese funding. Economists are concerned that a number of African governments, such as Zambia, may default on payments or be forced to restructure their obligations. This is a cause of concern. When Sri Lanka’s government struggled to make payments on Chinese debt in 2017, it faced heavy pressure from Chinese authorities and ultimately settled its debts by handing over the strategic Hambantota Port under a 99 year lease.

Interestingly, China has committed to write off all interest free loans advanced to African countries that are due by the end of 2020. These loans provided much need funding for African infrastructure projects. It seems fair to say, therefore, that Chinese funding is beneficial to African economies to the extent that they can afford to make repayments.

2. China as an Infrastructure Financier

African nations today are to some extent where China was a generation ago. In the past three decades, FDI from China helped the continent transform itself, resulting in the fastest sustained rise in living standards in human history. Chinese commitments to infrastructure in Africa amounted to $21 billion in 2015, making China the biggest bilateral infrastructure financier. Infrastructure development is one of the key reasons why Africans hold a positive view of China’s involvement in Africa.

A large part of China’s infrastructure development plans revolve around the Belt and Road Initiative (BRI) which aims to connect Asia, Europe and Africa. China has the skills, technology and financial capacity needed to build critical infrastructure in Africa through the BRI. This comes at a time when Africa needs to improve its infrastructure, particularly energy, roads and railways. For example, Kenya’s SGR Railway is a BRI initiative that has the potential to spark export and employment growth.

3. China as an Economic Participant

There are more than 10,000 Chinese firms operating in Africa across a broad range of sectors: manufacturing, services, trade, construction and real estate.

Investment returns in Africa are high relative to many developed regions, but in many cases, they are also risky, requiring comfort with unpredictable developing market conditions which many institutional investors shy away from. Chinese entrepreneurs, who have experience building their own nation in a similarly fast-paced and uncertain environment, are well suited to investing in Africa. Among the firms surveyed in the McKinsey study, more than half reported that they had taken three years or less to recoup their initial investment and reported profit margins of greater than 20%.

Interestingly, there are so many Chinese enterprises operating in Africa that it is difficult to conclude that the activity is being driven solely by the Chinese state or a single multinational company. While major infrastructure projects by Chinese SOEs might grab the headlines, the reality is that around 90% of the Chinese businesses in Africa are privately owned. Additionally, of the firms surveyed, 89% of their employees were African.

The findings above dispel a few myths about China’s role in Africa.

Myth 1

“China is a neo-colonialist nation that is focused on exploiting African resources and acquiring strategic assets.”

In reality, China plays a role in capacity building and human capital development. A close examination of China’s participation in Africa reveals that there are many small independent participants that are pursuing high market returns rather than one coordinated effort by the Chinese government.

Myth 2

“Chinese firms mainly employ Chinese nationals.”

As mentioned, around 89% of employees are sourced locally. Although, it appears that around 60% of management positions are held by Chinese nationals.

Final Remarks

China’s ambitious and high-profile role in Africa challenges the United States and the EU to think far more comprehensively and strategically about how they will engage with Africa. China’s expansion comes at a time of major parallel expansion of American and European commitments to Africa propelled by a growing interest in addressing global infectious diseases, energy security, counterterrorism, and the promotion of good governance. In contrast, China’s Africa Policy is not aimed at promoting a Chinese model for developing countries but on emphasizing common development, mutual understanding, and joint learning.

While China’s significance in Africa will most likely continue to grow, especially as some African states default on Chinese debt, Africa has the potential to benefit from this relationship through increased investment flows in infrastructure projects across the continent that offer job creation, training, and technology diffusion.

Oduor Ochieng is an Economics Honors student at the University of Cape Town. He has experience working in a Medical startup and Fintech company.

Images: Canva, Afrobarometer, John Hopkins SAIS China-Africa Research Initiative

One reply on “China’s Role in Africa”

The article is balanced but does not address the impact of Chinese government support in FDI. However, China’s efforts can’t be simply categorized as exploitative and their presence seen as the bogeyman’s. They need to clean up their act on community and public relations and cut back on bringing labor to countries where there is high unemployment and underemployment. But, the value of their capital can’t be taken for granted or can their willingness to take risk without HBS type analysis for each deal. The US in particular must step up and so can the UK post Brexit!