Venture capital (VC) is a type of investment in which a venture capital firm provides funding to early-stage companies with high growth potential. The goal of venture capital firms is to identify and invest in companies that have the potential to become successful and generate high returns for the investors in the fund.

What do VC firms do?

Venture capital firms typically invest in companies that are in the early stages of development, such as start-ups. These companies often have innovative ideas and products but lack the capital and resources to bring them to market. Venture capital firms provide the funding and expertise needed to help these companies grow and become successful.

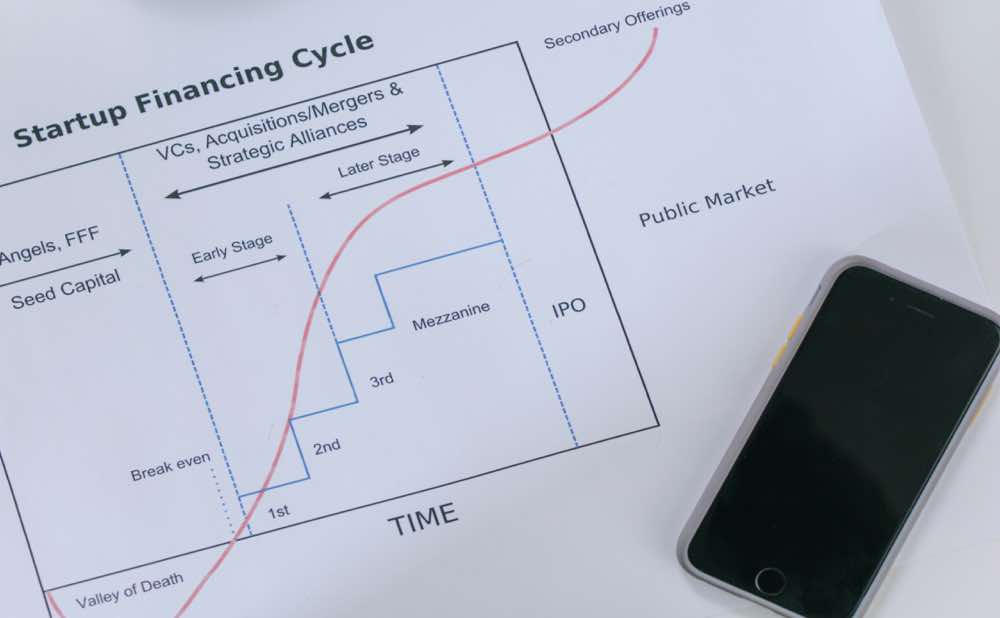

Venture capital firms have a wide range of investment strategies and focus on different types of companies and industries. Some firms specialize in seed funding, where they provide funding to young companies in the early stages of development. Other firms focus on early-stage funding, where they provide funding to companies that have already developed a product or service but need additional capital to scale their business. There are also firms that focus on late-stage funding, where they provide funding to companies that are close to becoming profitable or going public.

Venture capital firms also have different investment horizons and hold periods. Some firms have a short-term focus and aim to exit their investments within a few years, while others have a longer-term focus and hold their investments for several years. The length of the hold period depends on the investment strategy and the specific goals of the venture capital firm.

Roles within VC firms

Within a venture capital firm, there are several different roles that analysts can play. Junior analysts are responsible for performing research and due diligence on potential investment opportunities. This may include analyzing financial statements, assessing market trends, and conducting industry research. They assist in the development of investment thesis, deal sourcing, and initial screening of potential investments. They also assist in the preparation of marketing materials, and perform various other tasks necessary to support the investment process.

Senior analysts, on the other hand, are typically responsible for working with the investment team to develop and execute the firm’s investment strategy. They conduct in-depth due diligence on potential investments, including financial modeling, market research, and operational analysis. They also assist in the negotiation and structuring of transactions, as well as in the management and monitoring of portfolio companies.

Breaking into the VC industry

Breaking into the venture capital industry is not easy and requires a lot of hard work, determination, and patience. It’s also important to be prepared for the fact that you might face rejection and disappointment along the way. However, if you’re passionate about the industry and have the right skills and experience, there are many opportunities to make a successful career in venture capital.

One way to increase your chances of success in breaking into the venture capital industry is to gain experience in a related field such as investment banking, private equity, or management consulting. This will help you develop the skills and knowledge necessary to succeed in venture capital, such as financial analysis, market research, and deal-making. Additionally, internships, networking and informational interviews can also be beneficial.

Another way to increase your chances of success is to gain a deep understanding of the venture capital industry and the companies that it invests in. This can be accomplished by reading industry publications, attending conferences and networking events, and talking to industry professionals. This will help you stay up-to-date on the latest trends and developments in the industry, as well as give you a better understanding of what venture capital firms are looking for in potential investments.

The bottom line

Venture capital is an exciting and dynamic industry that plays a vital role in supporting the growth of new and innovative companies. It is challenging to break into, but with the right skills, experience, and mindset, you can make a successful career in venture capital. It’s important to be persistent, gain a deep understanding of the industry and its companies, and not be afraid to take risks and learn from your failures.

Zuhair Imaduddin is a Senior Product Manager at Wells Fargo. He previously worked at JPMorgan Chase and graduated from Cornell University.

Image: Pexels

Follow us now on LinkedIn.