AI isn’t coming, it’s already here.

And it’s transforming how businesses operate.

For product leaders, large language models (LLMs) aren’t just another shiny tech trend, they’re reshaping how businesses interact with customers, automate workflows, and make decisions. If you want to stay ahead of the curve, understanding LLMs is essential.

This article will break down how LLMs work, why they matter for product leaders, their impact on the business bottom line, and key challenges for implementation.

LLMs as Infinite Puzzle Solvers

Imagine a puzzle master who has studied millions of jigsaw puzzles. Instead of solving puzzles by knowing the final image, he relies on recognizing how pieces generally fit together based on experience. Given any new, incomplete puzzle, he can accurately predict what the missing pieces should look like.

LLMs work similarly.

LLMs are AI models designed to understand, process, and generate human-like text. These models are trained on massive datasets comprising books, articles, websites, and other textual sources. Rather than retrieving exact answers from memory, they predict the most likely next words based on what they have seen before.

Popular LLMs include OpenAI’s GPT-4, Google’s Gemini, and Meta’s Llama.

Unlike rule-based software applications, which follow strict instructions, LLMs learn from context and adapt their responses dynamically. This ability enables them to perform a variety of tasks, such as answering questions, summarizing content, translating languages, generating creative writing, and even coding. They even appear to demonstrate understanding and reasoning skills, which emerges from the interaction of complex probability distributions learned from their training data.

Why LLMs Matter for Product Leaders

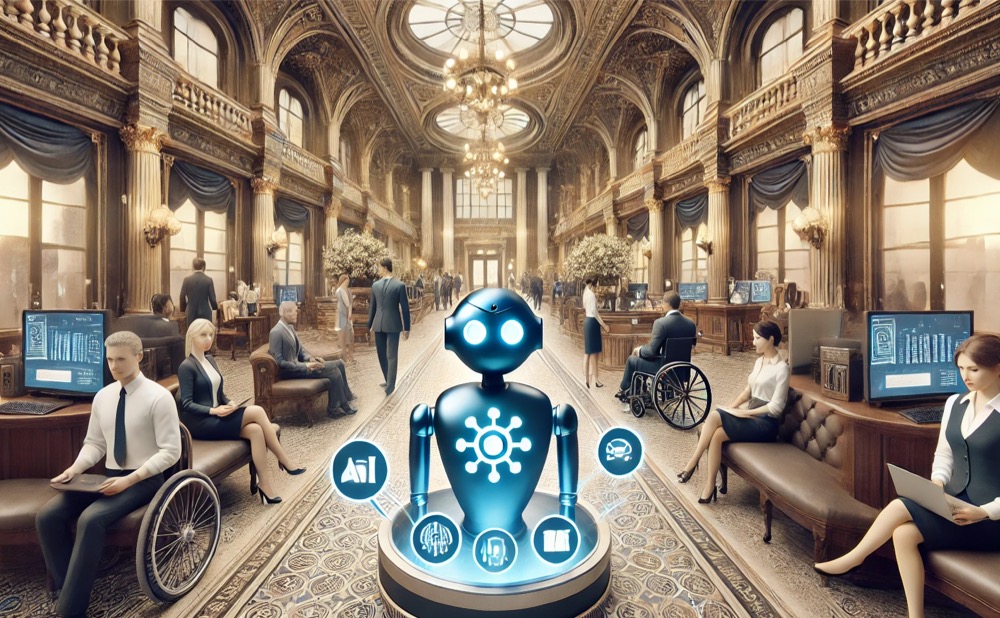

For product leaders, LLMs are revolutionizing product development by making it possible to build and deploy more intelligent, personalized, responsive, and accessible digital applications that enhance overall customer satisfaction.

Although many commentators are quick to downplay the capabilities of LLMs, the reality is that they can significantly boost workplace productivity by augmenting the intelligence of each individual worker. From writing assistance to automated data analysis, LLMs enable users to work more efficiently, thereby freeing up time to focus on higher-value tasks. According to MIT researchers, AI-assisted professionals complete writing tasks 40% faster with improved quality.

LLMs also enable hyper-personalization, whereby recommendations, marketing messages, and user interfaces can be tailored to the preferences of each individual user. McKinsey found that AI-powered personalization has the potential to drive revenue uplift of up to 30%.

Additionally, chatbots and AI-powered agents are more responsive than their human counterparts. They can provide real-time human-like interactions 24/7, improving customer support and engagement. According to Gartner, chatbots will become the primary customer service channel for 25% of organizations by 2027.

Furthermore, voice-enabled and natural language interfaces make digital interactions more intuitive, particularly for users who are not tech-savvy or for those with disabilities. The World Economic Forum highlights that AI-driven accessibility features have the potential to improve digital inclusion worldwide.

Impact of LLMs on the Bottom Line

LLMs are not just a technological innovation, they are also expected to drive significant financial gains for businesses by enabling both increased revenues and decreased costs, thereby boosting profitability. According to a McKinsey report, AI-powered automation has the potential to generate up to $4.4 trillion in global economic value annually.

According to BCG, retailers that use AI-driven personalization and dynamic pricing can increase gross profit by 5 – 10% while also sustainably increasing revenues.

LLMs can support revenue growth by, for example, enabling businesses to rapidly analyze vast quantities of data, and quickly extract the most meaningful insights to make important strategic decisions about market entry, product development, and pricing. According to McKinsey, data-driven companies are 23 times more likely to acquire customers.

From summarizing lengthy documents to drafting emails and generating reports, LLMs can reduce operating costs by streamlining workflows and reducing manual effort. According to Accenture, more than 50% of work in the banking sector has a high potential for automation. Juniper Research found that AI chatbots could save the banking and healthcare sectors $8 billion annually.

Implementation Challenges

While the potential of LLMs is vast, product leaders must approach their adoption strategically.

Here are three key challenges to consider.

1. Bias: Garbage in, garbage out

The output generated by LLMs depends not only on the hardware and software being used to run the computations, but also on the quality of the original training data. Output will reflect the information as well as biases present in the training data, which can lead to responses that are inaccurate, a threat to public safety, culturally insensitive, or otherwise politically untenable. Careful model fine-tuning and monitoring are essential.

2. Computational costs

Running large LLMs requires significant computational power, leading to high infrastructure costs. Businesses must assess whether cloud-based solutions, such as OpenAI, or on-premise deployments are more suitable.

3. Data privacy

Handling sensitive customer data with AI models necessitates stringent privacy protocols and compliance with regulations such as GDPR and CCPA.

The bottom line

LLMs are transforming industries by making interactions more natural, workflows more efficient, and decisions more data-driven.

For product leaders, understanding the power and limitations of LLMs is crucial to leveraging them effectively.

By thoughtfully integrating LLMs while mitigating risks, businesses can unlock unprecedented value, boost customer satisfaction, and stay ahead of the competition.

Zuhair Imaduddin is a Senior Product Manager at Wells Fargo. He previously worked at JPMorgan Chase and graduated from Cornell University.

Image: DALL-E

🔴 Like this article? Follow us now on LinkedIn to stay in the loop and connect with other readers.

Sharpen your edge in consulting