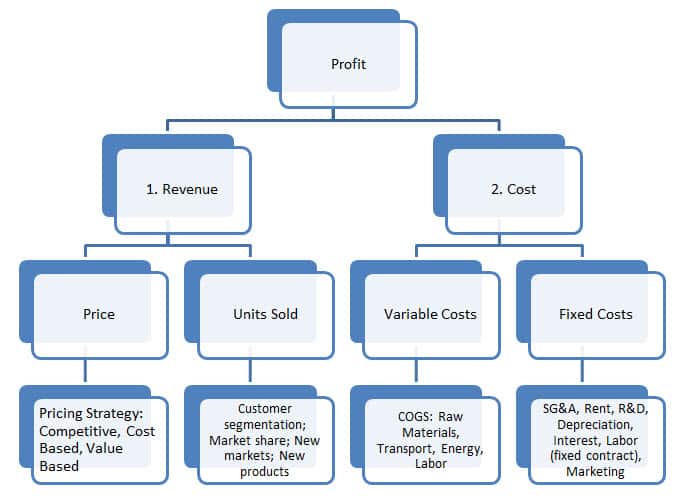

The profitability framework is probably the most important framework for solving consulting case questions

Profit equals revenue minus cost.

1. Revenue

Revenue is normally thought of as being a function of price per unit and units sold.

Declining revenue can derive from a fall in prices or a reduction in units sold, and can be examined in four steps.

Step 1: Segmentation

What are the major revenue streams? It will typically be a good idea to segment units sold, and this might be done by:

- Product;

- Product line;

- Distribution channel;

- Region;

- Customer type (new/old, big/small); or

- Industry vertical.

Step 2: Examination

What percentage of total revenue does each revenue stream represent? Compare current and historical figures to identify how these percentages have changed over time.

Step 3: Diagnosis

What is the underlying cause of the problem?

Step 4: Response

Develop a strategic response.

1.1 Diagnosis

If faced with declining prices or volume, factors to consider include the following.

1. Macro Economy

- PEST Analysis: Political upheaval; Economic decline; Socio-cultural factors; Technology. Have there been any recent or impending changes?

2. Customers

- Market growth: Has market growth slowed forcing competitors to compete over market share?

- Customer needs and preferences: Have customer needs and preferences changed?

- Distribution Channels: What channels are used to reach customers? Has there been a change in the cost effectiveness of these channels?

- Price Discrimination: Can the company distinguish between customers and charge different prices to different customer segments?

3. Competition

- Rivalry: Have competitors lowered their prices? How does the company’s product mix, product quality, and cost structure compare to the competition?

- Substitutes: Has the price performance of substitutes improved?

- Barriers to entry: Has it become easier for new competitors to enter the industry?

- Buyer bargaining power: Has there been an increase in customer bargaining power?

4. Company

- Market Power: Does the company have market power (product differentiation, proprietary technology, economies of scale, network effects)?

- Products: What products and product mix does the company offer? How do these compare to the competition? Is there something different about the products that might allow the company to raise prices?

- Value chain analysis: Consider value chain activities: access to raw materials; operating capacity; inventory handling and distribution.

1.2 Response

Declining prices

In response to declining prices, there are three pricing strategies to consider.

- Competitive pricing: How do prices compare with the competition? Is the pricing appropriate given the product’s quality and relative position within the market? How is the competition likely to respond to the firm’s pricing strategy?

- Cost based pricing: What is the company’s cost structure? What percentage of costs are fixed and variable? A company that has high fixed cost and low variable costs will benefit from economies of scale and so may want to lower prices to increase market share.

- Value based pricing: Is the product a commodity or differentiated? Do different customer segments have a different willingness to pay? Are customers price sensitive (see “Price elasticity of demand”)? If prices are changed, how will this affect sales volume and product perception?

Declining sales volume

Faced with falling sales volume, there are four growth strategies that a business might choose to employ: market penetration, market development, product development, and diversification.

- Market penetration: A strategy to increase sales to existing customers and increase market share. Market penetration can be pursued through a combination of initiatives relating to pricing, product, placement and promotion (see “Four P’s Analysis”).

- Market development: A strategy to sell existing products to new markets which might include new regions, customer segments, or distribution channels.

- Product development: A strategy to sell new products to existing customers to increase share-of-wallet.

- Diversification: A strategy to develop new products for new markets. This is the highest risk option. Look for markets with strong market growth and high levels of industry attractiveness (see “Porter’s Five Forces”).

2. Costs

The third driver of declining profitability (after prices and volume) is rising costs.

2.1 Diagnosis

Examine the cost structure of the business to locate the source of rising costs. This might be done by segmenting costs into value chain activities: inbound logistics, operations, outbound logistics, sales & marketing, customer service.

Consider also fixed costs and variable costs. Have there been any significant changes in the company’s cost drivers? How do costs compare to the competition?

2.2 Response

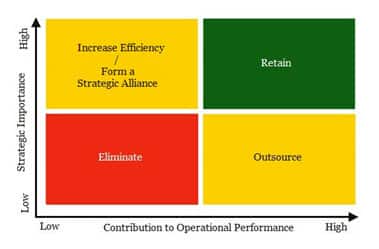

In responding to rising costs, there are three questions that a firm should consider:

- How long will it take to reduce major cost drivers?

- Are the activities strategically important?

- To what extent do the activities contribute to operational performance?

A company will want to eliminate or outsource costly activities that have low strategic importance. If the activity has a low contribution to operational performance it should be eliminated, and if it has a high contribution to operational performance it should be outsourced.

A company will want to retain control of activities that have high strategic importance. This can be done by forming a strategic alliance or increasing efficiency.

If a company wants to increase efficiency, then it will need to find ways to reduce costs.

Common cost reduction techniques include:

1. Procurement

- Consolidate procurement or renegotiate supply contracts.

2. HR Management

- Reduce labour costs through decreasing salaries, training, overtime, benefits and healthcare, introducing employee stock ownership, and right sizing.

3. Technology Development

- Use IT and digital technology to reduce communication and organisational costs.

- Employ more advanced production technology.

4. Logistics

- Partner with distribution companies (e.g. FedEx).

5. Operations

- Outsource manufacturing to a lower cost jurisdiction (e.g. China/India/other).

- Improve the utilisation rate of plant, property and equipment.

- Relocate headquarters to lower cost city, region or country.

6. Finance

- Reduce working capital including inventory and accounts receivable.

- Refinance outstanding debt.

- Divest non-core assets.

[For more information on the consulting interview, download “The HUB’s Guide to the Consulting Interview“.]