Another framework you should know is the Mergers & Acquisitions framework (M&A framework). The reason that this framework is worth introducing is due to the increasing frequency of M&A cases confronting candidates in the case interview. Needless to say, M&A deals are notoriously complicated financial activities, which makes candidates panic when they are prompted with an M&A case. However, you will find out in this article why you have no need to worry, as long as you can remember just a few fundamental principles of this type of case.

To start with, what is M&A? For those who are not familiar with this term, M&A refers to a situation where one company buys part or all of the business of another company. If one company takes a controlling interest in the other, it is regarded as an acquisition. If the two companies combine their businesses and shareholders, it is regarded as a merger. Of course, financial experts have many detailed definitions of M&A. Here, you just need to remember this simple description.

For the sake of M&A cases, candidates are usually asked to be an advisor for the buyer rather than the seller. So, what you should really think about are things from the buyers’ perspective.

As M&A is a highly professional service, don’t bother trying to understand the roots or origins of why the M&A framework stands as it is. Rather, let’s jump into the framework and explore each component.

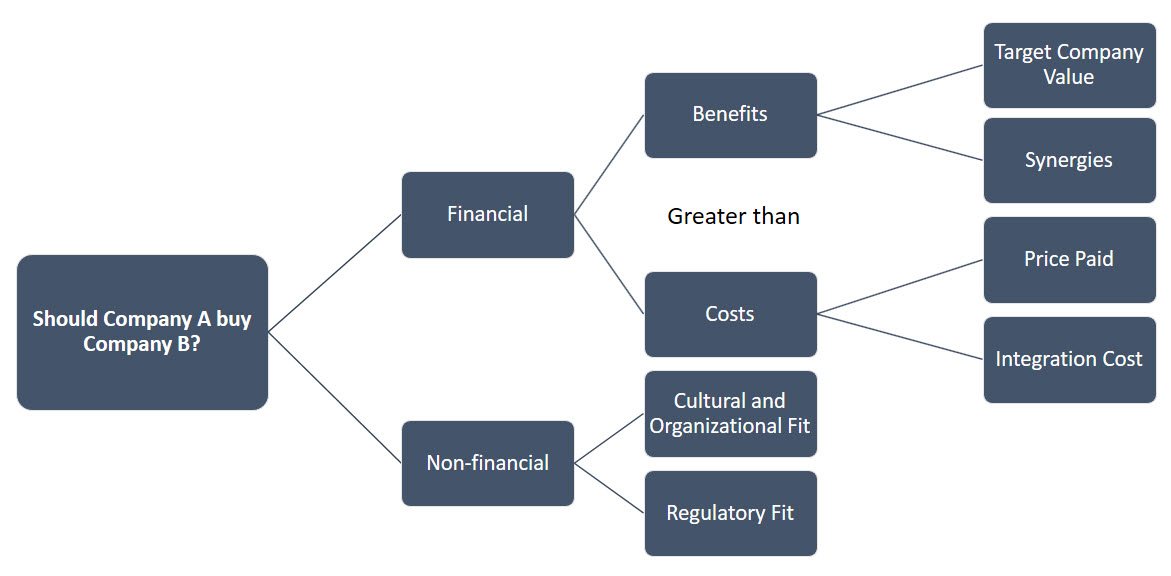

The M&A framework is set out below.

The framework splits an M&A case into two main chunks: Financial and Non-Financial. Yes, M&A is not all about finance! The financial part mostly involves quantitative analysis while the non-financial part focuses on business acumen.

In the financial part, the underpinning logic is for an M&A deal to make sense for the buyer the benefits it gains should be greater than the cost it pays. The benefits come from the value of the target company and any synergies that result from combining the two businesses together.

There are three main valuation methods you can use to estimate the value of the company:

In most cases, you should expect to use any of these three methods to estimate the target company’s value. To be efficient, I would recommend that you click the three links above and read the articles in order to understand each valuation method. These articles are written by professionals in a reader friendly language; you will definitely appreciate them.

The second source of benefits are ‘synergies’. Synergies to the buyer in an M&A deal come from either revenue growth or cost reduction. You should use your basic business common sense to find out whether there are synergies and where they come from for the specific deal you are considering. You can find a summary list of possible synergies below. The list is not exhaustive, you may find other sources of synergies depending on the details of the case.

Figure 2, Sources of Synergies

Moving on now to consider Costs. There are two main costs that need to be considered: the acquisition price and integration costs. The acquisition price is quite straight forward, how much is the buyer willing to pay? In most cases, this will be a number that candidates can get from the interviewer. If not, candidates can easily assume a starting price level by multiplying the number of shares outstanding by the share price. Integration costs include costs incurred for integrating IT systems, operational processes, and organizational structure.

Once you have analysed the Benefits and Costs of the M&A deal, review whether the benefits are greater than the costs. If they are then you have reason to assess the non-financial aspects. If not, then you can make a conclusion. No M&A deal will be made without sufficient financial incentives for the buyer.

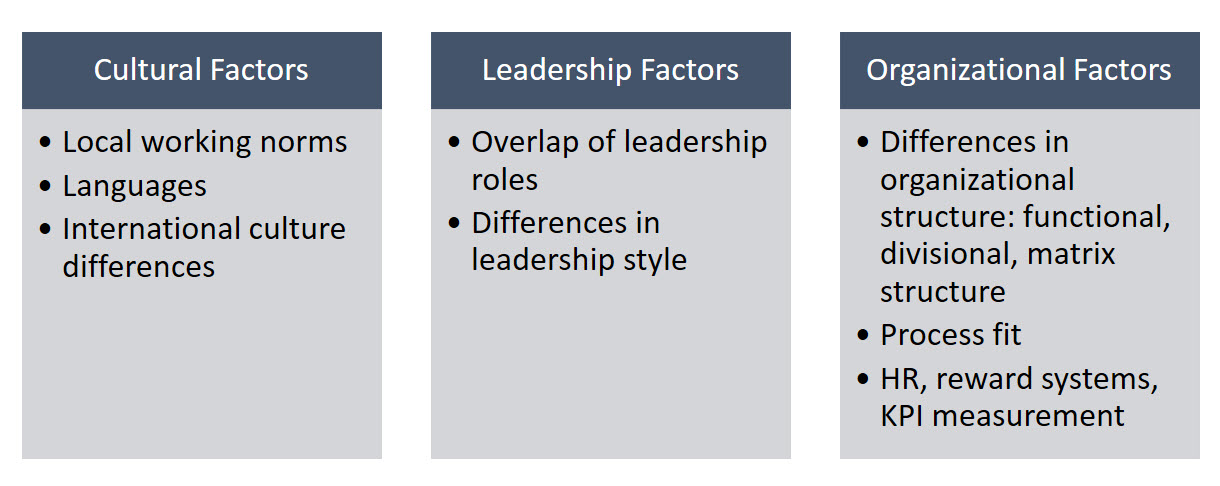

Next, let’s have a look at the second chunk of the M&A framework: the non-financial part. Here is where your business acumen kicks in. Non-financial issues include cultural and organizational fit, and regulatory fit.

Understanding cultural and organizational fit requires you to consider the culture, leadership, and organizational structure of the two companies. There are other issues you can explore, however I believe these three are the most important. You can find a summary of the main issues below.

Figure 3, Cultural and Organisational Fit

The final non-financial issue to consider is regulatory fit. This will vary from country to country. But at a high level, candidates should talk about major regulatory concerns such as antitrust law, shareholder regulation, tax law, and government supervision. Candidates are not required to know everything about possible regulatory issues, especially if they are interviewing in a country with which they are not familiar. But it is important to highlight the above common areas that are worth looking into.

In summary, keeping the M&A framework in mind is not difficult for most candidates. And once remembered, you just need to follow the steps to solve the case. Since the M&A case is usually regarded as a difficult one, the interviewer will not push you to use a detailed valuation method or to consider regulatory issues that are not well known to all candidates. For management consultants, M&A does not involve the same work as for an investment banker. The important thing is to have a logical break down of the M&A deal and know what each part is about.

Free Download: This guidebook distils all of Mike’s insights on how to achieve success in your journey towards a career in management consulting: download now!

Mike Ni believes that technology is the engine of the future, while business capability is the wheel!

Image: Flickr