With the US Federal Reserve printing up several trillion dollars of new money in 2020, market commentators have been banging the war drum. Inflation is coming!

Some suggest gold as an inflation hedge, and others suggest bitcoin. But before we look at these two potential solutions to the inflation problem, let’s first consider whether inflation is likely to be a problem in the first place.

The basic theory that we can use to predict price inflation is the quantity theory of money.

The formula looks like this:

M x V = P x Y

Or in words:

Amount of money (M) x Rate of spending (v) = Price level (P) x Real value of production (Y)

Since the real value of production tends to grow slowly and steadily from year to year, COVID-19 disruptions notwithstanding, we can look at changes in the money supply and rate of spending in the economy in order to predict changes in the price level.

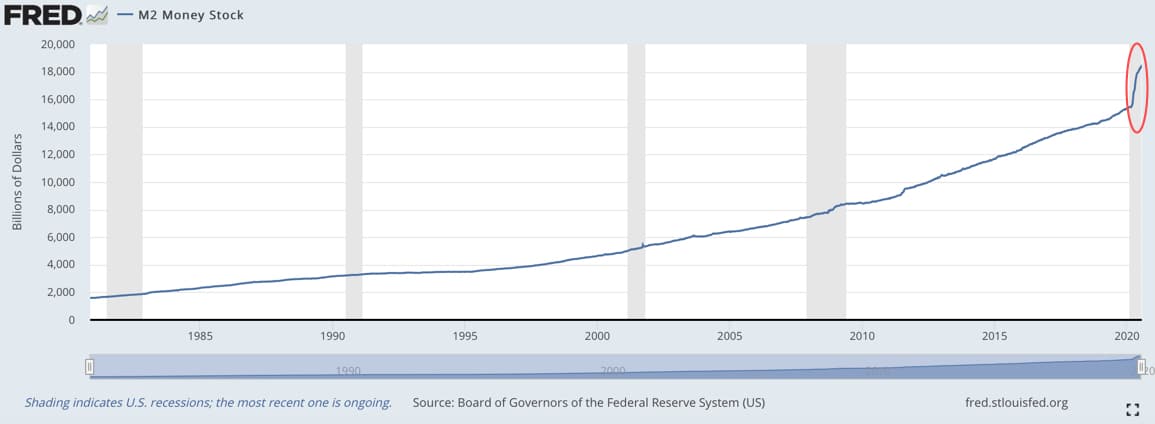

Figure 1 below shows that the money supply in America grew steadily from 1980 to 2020, but with a distinct jump upwards of around 19% in the first half of 2020.

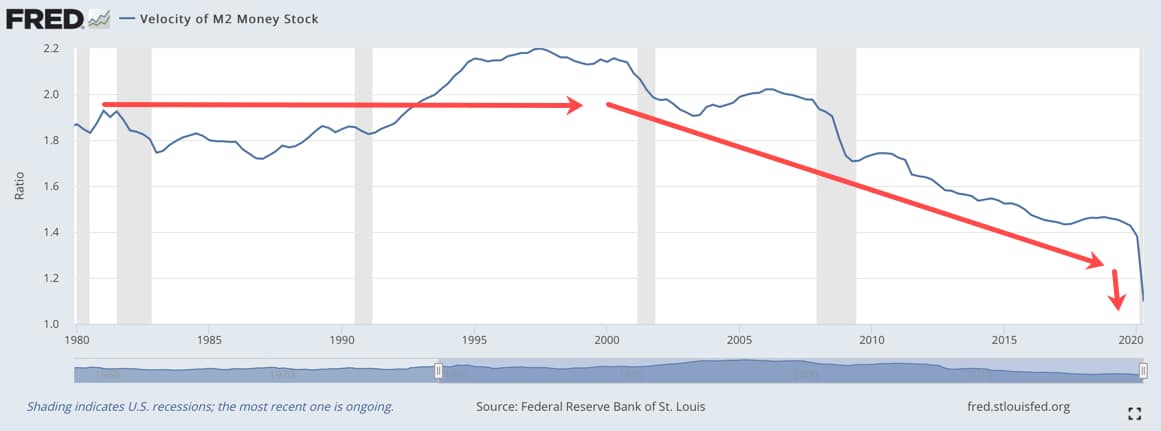

Figure 2 below shows that the rate of spending held fairly constant from 1980 to 2000, declined steadily from 2000 to 2020, and then dropped abruptly by around 23% in the first half of 2020.

From these graphs, we can see that the increased money supply in the first half of 2020 was more than offset by a reduced rate of spending. At first glance, this suggests that price inflation shouldn’t be a concern, and that we may even see mild deflation in the short run. However, it’s not quite that straightforward. The real value of production in the US also plummeted by around 10.6% in the first half of 2020, which means that prices could theoretically go up.

Deflation or inflation, which will it be?

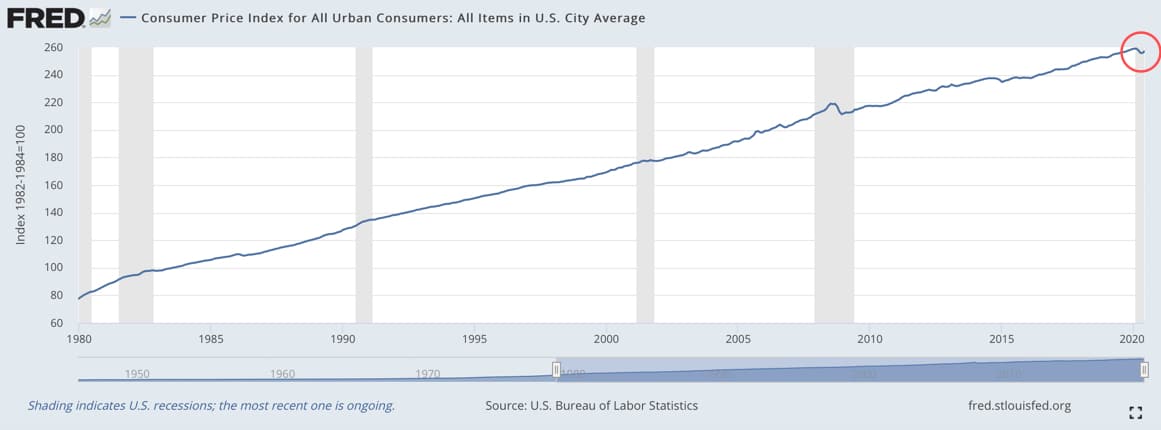

According to Figure 3 below, which shows CPI data from the Federal Reserve website, the price level in the US fell by 0.6% in the first half of 2020. So, it looks like America is experiencing mild deflation in the short run.

Does this mean that the market commentators are crying wolf about the risk of inflation?

Not quite.

The velocity of money is currently at a historic low of around 1.1. If confidence were to return, and the rate of spending were to increase to levels seen during the 1980’s or the heady days of the late 1990’s, then this could very quickly translate into a double digit rate of inflation. While this is not likely to happen in 2020, it does seem like a plausible scenario in the medium run after the ranks of unemployed eventually secure new jobs, and consumer confidence returns.

Hedging Inflation Risk

While inflation risk appears to be real, driven by a sharp increase in the money supply, the good news is that it appears to be a medium term risk factor. Now is a good time to prepare yourself, and there is still time.

Inflation is a general increase in the price level in an economy, which corresponds with a general decrease in the purchasing power of the nation’s currency.

The easiest way to hedge against currency devaluation is to buy real assets that will retain their value as the currency is debased. Dollar denominated assets like bank deposits or bonds tend to lose their value during a period of high inflation because their value is measured in dollars. In contrast, the value of real assets like land, fine art, gold, or bitcoin are likely to be preserved during a period of high inflation. Some commentators have argued that Warren Buffett’s $10 billion acquisition of Dominion Energy’s natural gas assets was in part motivated by a desire to acquire hard assets as a hedge against inflation.

Commentators like Peter Schiff trumpet the merits of gold, and Peter’s arch-rival Max Keiser is equally enthusiastic about bitcoin. Below we will consider some of the pros and cons of these two options.

Gold

“Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked: “Account Overdrawn.” — Ayn Rand

Gold is often touted as having ‘intrinsic value’, or as Ayn Rand notes above, ‘objective value’. I take this to mean that gold is a chemical element that possesses all six qualities of good money. That is to say, gold is:

- Durable – Unlike silver, copper or iron, gold does not tarnish or rust. It has an extremely high melting point, and so is basically impossible to destroy.

- Portable – Gold is denser than silver, and more value can be stored in the same amount of weight, making it a convenient and portable store of value. However, its potability also makes it easy to steal, meaning that it needs to be hidden or stored in a secure location. Advocates of Bitcoin claim that gold is not portable enough, since it can’t be used for digital payments. Under the current global monetary system this criticism is true, however if we were to return to a gold standard then bank deposits and electronic fund transfers would be backed by gold.

- Divisible – Gold can be divided into coins of different weights in order to store a greater or lesser amount of value.

- Uniform – Gold is not a commodity like oil, wheat, or corn. It is an element on the periodic table, and so one ounce of pure gold will always be exactly the same as any other.

- Scarce – The natural scarcity of gold is a key part of its value. Gold is not only scarce, but requires work to find, dig out of the ground, and refine. This means that a certain weight of gold is proof of a certain amount of work. Once produced, gold tends to be promptly buried again, which further limits its supply.

- Generally acceptable – Apart from being shiny and nice to look at, gold possesses all of the qualities of good money. Since simple methods exist for testing its purity, gold of known weight and fineness is generally acceptable as a means of payment or, if not, then at least easily convertible into cash which can be used for that purpose.

Bitcoin

“Bitcoin is like anything else: it’s worth what people are willing to pay for it.” — Stanley Druckenmiller

While gold appears to have been used for at least 40,000 years, Bitcoin was only invented 11 years ago. As a result, it has not yet proven its worth during a period of political or economic uncertainty, such as a major financial crisis or war.

Created by a person or group of people known as Satoshi Nakamoto, Bitcoin is a decentralised digital currency that records transactions in a distributed ledger called the blockchain. Advocates of Bitcoin argue that, like gold, it possesses all of the qualities of good money, but with at least four (4) benefits:

- Transactions are recorded on the blockchain – Since transactions are recorded in chronological order on the blockchain, each bitcoin can only be spent once. This means that Bitcoin is ideally suited for digital transactions.

- Blockchain is decentralised and trustless – Financial intermediaries are a weak point in the global monetary system because they expose users to counterparty risk. Banks can go bankrupt, and the central bank can impose a hidden tax on citizens by printing unlimited amounts of fiat currency. Bitcoin removes this problem by running on a decentralised network that does not require financial intermediaries.

- Artificial scarcity – According to the current bitcoin protocol, the supply of bitcoins cannot exceed 21 million. Advocates of Bitcoin suggest that this makes it even scarcer than gold, and so an even better store of value. One problem, of course, is that bitcoin’s protocol could be changed to allow a larger supply. However, even if that doesn’t happen, Bitcoin’s artificial scarcity may limit its usefulness as a digital currency. Holders of bitcoin have an incentive to horde bitcoins rather than spend them. As a result, if Bitcoin does go mainstream, it is likely to function more as digital gold than as a digital currency.

- Volatility – The price of gold is volatile, but the price of Bitcoin is notoriously even more volatile. An unpredictable price sounds like a drawback, but Bitcoin advocates are not deterred. They recommend buying bitcoin periodically in order to dollar cost average into the asset. Also, when inflation kicks in, and gold prices start to rise, they believe that Bitcoin’s price will rise to an even greater extent. This theory sounds plausible, but it is yet to be tested. It is also worth noting that an asset with more price volatility exposes investors to more risk in the short run.

Despite these supposed benefits, Bitcoin also has at least five (5) drawbacks that investors in gold are not exposed to.

- Vulnerability to cyberattacks – Since Bitcoin is politically independent, governments may have limited ability or incentive to prevent, investigate or punish hackers who steal bitcoin, especially if the hackers are located in an unstable or unfriendly nation. Bitcoin exchanges are highly vulnerable to cyberattack due to the large number of bitcoins concentrated in one place. The most notorious example was Mt Gox, a bitcoin exchange located in Tokyo, which was hacked in 2014. This resulted in the loss of approximately 850,000 bitcoins worth around $460 million. Since Bitcoin exchanges don’t operate like credit cards, which provide a fraud protection guarantee, bitcoins, once stolen, are difficult to recover.

- Dependence on the Internet – While it is hard to believe that the Internet could cease to function, or that access might be disrupted or restricted, it’s not impossible. If a solar flare caused a widespread loss of computer data, or a wartime enemy were able to neutralise the Internet, or disrupt people’s access to it, then holders of bitcoin could be left empty handed.

- Risk of surveillance – One of the features of Bitcoin is that every transaction is recorded on the blockchain as well as each counterparty’s public key or pseudonymous username. This means that transactions can always be verified, and users remain anonymous. However, if a user’s public key or username becomes known, then their transactions could be surveilled. This is a privacy risk, which could adversely impact people living in tyrannical regimes or politically unstable regions.

- Risk of obsolescence – Gold is a naturally occurring element, and so its value is intrinsic. On the other hand, Bitcoin is a cryptocurrency, which could be superseded by another cryptocurrency or other payments technology. An analogy would be the US dollar being superseded as the global reserve currency by the Chinese yuan. The US dollar would still exist, but its value and usefulness would be significantly diminished.

- Regulatory risk – Every national government wants to maintain control of its own currency. If none of its other drawbacks prevent Bitcoin’s ascent, the cryptocurrency could become a victim of its own success. If Bitcoin becomes a strong rival to national currencies, governments may decide to outlaw or restrict its use. Alternatively, countries may launch their own state backed digital currencies, as China appears to be doing.

Final thoughts

Inflation appears to be a medium term risk factor in America and by extension globally, given that the US dollar is the global reserve currency. Investors can hedge themselves against inflation by buying real assets like land, fine art, gold, or bitcoin.

Gold possesses all of the qualities of good money, and so is likely to be a good hedge against inflation, and a sound insurance policy during a period of political or economic uncertainty.

Given its volatile price, and its loyal community of enthusiasts, Bitcoin may offer higher returns than gold in the short to medium run. However, it also comes with a shopping list of potential risks that gold does not possess.

This article may have overlooked or misconstrued some important ideas, and is not intended as investment advice. I hope it contained some information that you found useful as you aim to protect your wealth and purchasing power in 2020 and beyond.

Image: Pixabay