Since the advent of Bitcoin in 2008, digital currency has been a growing trend and a growing area of interest for consultants, businesses, fintech investors, central banks, and governments.

In this article series we will explore three basic questions:

- What is digital currency?

- What is the value of digital currency?

- What are the potential risks?

1. What is digital currency?

A digital currency is simply a record stored on a device or computer network, which can be transferred from one user to another. Balances can be stored in a digital wallet online, or in ‘cold storage’ in a digital wallet not directly connected to the Internet such as on a desktop, mobile phone, or USB stick.

Digital currency vs electronic banking

Before we explore some of its important features, it is worth distinguishing ‘digital currency’ from traditional methods of electronic banking. You are probably familiar with paying for things using a debit card, or mobile payment service like Apple Pay, Google Pay, Venmo, WeChat Pay, or Alipay. Bank deposits can be transferred electronically, but this differs from digital currency in at least three respects:

- The most obvious difference is that bank deposits represent a claim on physical cash that can be withdrawn from an ATM. In contrast, a digital currency only exists in electronic form, it is not a claim on physical cash, there is no cash.

- Another difference is that electronic banking involves interacting with the banking system. When a payment is made, an electronic instruction is sent to each party’s financial institution to debit or credit an account balance by a certain amount. In contrast, a digital currency can operate on a peer-to-peer network that allows a buyer to settle a transaction directly with a seller without a financial intermediary.

- A final distinction is that bank deposits and cash are typically considered perfect substitutes; $100 in the bank is just as good as $100 in cash. In contrast, a digital currency might be thought of as a ‘digital token’ and, just like a real world commodity, its price could vary.

Six dimensions of digital currency

A number of digital currencies already exist, the two most popular being Bitcoin and Ethereum. Over the coming decade, many more digital currencies will be created by entrepreneurs and governments. They are likely to differ along six key dimensions:

- Legal status

- Control of the money supply

- Role played by banks

- User privacy

- Level of accessibility

- Acceptability as a means of payment

Let’s explore each of these six dimensions in turn.

1. Legal status

A digital currency can be regulated or unregulated.

The very first digital currencies were all created by pioneers and were thus completely unregulated. These included DigiCash (1989 – 1998), e-gold (1996 – 2009), and Liberty Reserve (2006 – 2013). This also includes Bitcoin (created in 2008) and Ethereum (created in 2015).

An unregulated digital currency is controlled not by a central bank but by its developers, founding organization, or network protocol. The US Department of Treasury refers to unregulated digital currencies as ‘virtual currencies’, and has clarified that they are not legal tender. This means that unregulated digital currency is not legally recognized by the American government as a means of settling monetary debts or paying taxes.

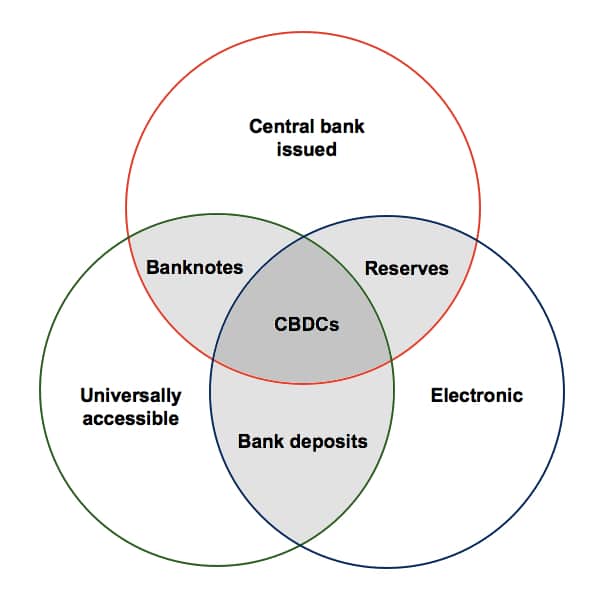

In contrast, a regulated digital currency would be one which is backed by the full force of the state, enjoying legal tender status, and most likely controlled by a central bank. Although none have yet been successfully established, regulated digital currency is a hot topic of conversation, and is often referred to by insiders as ‘Central Bank Digital Currency’ (CBDC).

A few countries are actively trying to develop a CBDC:

- In February 2015, Ecuador became the first country to roll out a digital currency in an apparent attempt to complement or replace its dependence on the US dollar. However, by December 2017, its system was decommissioned, having failed to attract a significant number of users or volume of payments.

- In February 2020, Sweden’s Riksbank announced that it is conducting a pilot project with Accenture aimed at developing a digital krona that is simple and user friendly.

- In April 2020, the People’s Bank of China began pilot testing a system known as ‘Digital Currency Electronic Payment’ in four large Chinese cities – Shenzhen, Suzhou, Xiong’an, and Chengdu – as well as some locations where the 2022 Winter Olympics will be held.

- In August 2020, the Federal Reserve stated that it is partnering with MIT to build and test a digital currency.

2. Control of the money supply

Control of a digital currency can be centralized or decentralized.

Cryptocurrencies like Bitcoin and Ethereum are decentralized. The supply of new cryptocurrency is controlled not by a central authority but by the network protocol and the activity of a large number of users, known as miners, who solve complex computational math problems in order to verify transactions on the network and at the same time obtain newly created cryptocurrency.

In contrast, CBDCs will most likely be controlled by a central bank. Decentralized digital currencies are viewed as a threat by central bankers because they cannot be controlled, and so the rising popularity and market capitalization of Bitcoin has given central banks an increased incentive to accelerate development of CBDCs. If a decentralized digital currency were to become widely accepted then central banks could lose their ability to intervene in the economy by controlling the money supply.

3. Role played by banks

A digital currency can settle payments on a peer-to-peer basis or via a financial intermediary.

Cryptocurrencies like Bitcoin and Ethereum allow for peer-to-peer transfers. Cryptography is used to verify transactions which are then recorded in a public distributed database known as a blockchain. In this way, transfers are settled directly on the network without passing through a financial intermediary.

CBDCs will most likely allow for both peer-to-peer payments as well as transfers that pass through a financial intermediary such as a commercial bank or central bank.

It is not 100% clear how CBDCs will be deployed, but it may work as follows. Each nation will have a CBDC, and each nation’s central bank will provide a reliable, fast, and efficient centralized ledger for settling transactions. Commercial banks will interface between the national ledger and consumers and provide various financial products such as digital wallets, credit cards, and insurance. Individuals will be able to store digital currency on their smart phone, and make transfers on a peer-to-peer basis using near field communication technology.

4. User privacy

Each digital currency protects privacy to a different degree. Unlike cash, all digital currencies produce transaction records which leave a trail of digital breadcrumbs. Some digital currencies aim to provide full blown privacy (e.g. Monero), others record transaction details on a public blockchain with user identities obscured (e.g. Bitcoin), and others will record transaction data on a government server (e.g. CBDCs).

5. Level of accessibility

Digital currency can be ‘retail’ (fully accessible to the general public) or ‘wholesale’ (accessible only to a restricted group of users such as large financial institutions).

A wholesale digital currency already exists in the form of central bank reserves, which banks park at the central bank to satisfy reserve requirements.

Cryptocurrencies like Bitcoin are a form of retail digital currency since they are fully accessible to the general public.

It seems that CBDCs will also be made universally accessible. Functioning in this way, CBDCs will replace not only central bank reserves but also bank deposits and banknotes. In other words, CBDCs looks set to become the new base money (MB) plus the most liquid component of the broad money supply (M1).

6. Acceptability as a means of payment

Digital currency can be widely used as a means of payment or used only in niche applications.

It goes without saying that, in order for a digital currency to function as an actual ‘currency’, it must be generally acceptable as a means of payment within the nation (or group of nations) where it used.

Cryptocurrencies like Bitcoin and Ethereum are not widely accepted as a means of payment [pdf]. According to Bitcoin enthusiast Max Keiser, Bitcoin is ‘digital gold’. This means it functions primarily as a store of value rather than a means of payment. Gold bug and economist Peter Schiff is less glowing in his assessment of Bitcoin, referring to the cryptocurrency as fool’s gold, a Ponzi scheme, and as a digital token with no intrinsic value whose price will eventually collapse to zero.

As regulated digital currencies, CBDCs will be generally acceptable as a means of payment, if only due to government decree. As a result, to the man in the street, the transition from using bank deposits to CBDCs will likely go unnoticed. According to the World Economic Forum, 50% of retailers in Sweden expect to go cashless by 2025. And in China, more than 75% of people already prefer digital payments to cash.

Final thoughts

Digital currency is a growing trend that has attracted interest from entrepreneurs and governments. Sweden and China are two countries leading the way towards developing a Central Bank Digital Currency and building a cashless society, although America appears to be hot on their heels.

It is uncertain which features the most widely accepted digital currencies will possess. CBDCs will most likely be regulated, centrally controlled, and allow for payments that can be settled on a peer-to-peer basis or by a financial intermediary. At the same time, the free market will continue to offer competing alternatives.

In the next two articles we will explore the value of digital currency, and the potential risks.

Image: Pexels