Having taught undergraduate economics for a number of years, I wanted to pen a list of some of the ideas that appear flawed but which form the basic pillars of mainstream economics.

Although professional economists are often familiar with the weak points in their discipline, the problem lies in the fact that the ideas are habitually taught to first year university students, and for many of these young people it will be their only exposure to formal economic thought. The justification for the status quo is usually that “all models are wrong, but some are useful”. While simplistic assumptions do make for easier math, and can help to predict market outcomes in stylised scenarios, the real world is both complex and dynamic. In order to develop a more coherent world view that can reliably inform individual, business and government decision making, we must be willing to question some of the basic ideas that are foundational to mainstream economic thinking.

1. Rational decision making

Economics assumes that people are rational, which means they consider all of the available options and choose the best one, the one which offers the maximum payoff. This assumption is popular because it allows simple mathematics to be used to solve maximisation problems.

In reality, people are lazy. They don’t maximise, they satisfice. People consider a few options that are all more or less good enough and pick the one that seems the most satisfactory. Herbert Simon called this approach to decision making ‘bounded rationality‘.

2. Profit maximisation

Economics assumes that firms aim to maximise profits.

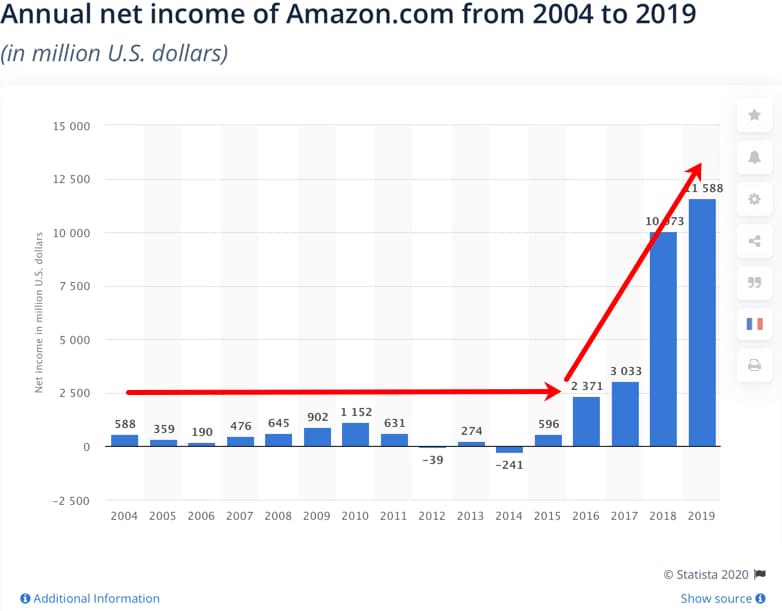

In reality, firms have a range of goals. Corporate finance academics argue that firms should act to maximise shareholder value, since shareholders are the owners of the firm. This may not be the same as maximising profits. For example, Amazon earned only modest profits from 2004 to 2015, choosing instead to focus on increasing market share and developing new products.

3. Willingness to pay

Economics assumes that each person has a certain maximum willingness to pay for each good. This makes it possible to determine the quantity demanded at each price level and to build a demand schedule.

In reality, people often don’t know what they want and there is no objective method of determining whether a price is “too high”. People tend to change their willingness to pay based on time of day, day of the week, and social context. They also tend to view a good as “cheap” when offered a discount from an artificially inflated starting price (this effect is known as anchoring).

Since willingness to pay cannot be objectively determined, it is also impossible to objectively calculate consumer surplus (the benefit which consumers get from participating in a market). Arguments that categorically favour free trade by reasoning that decreases in domestic production are more than offset by increases in consumer surplus overlook this point.

4. Factors of production

Economics assumes that there are three main factors of production: land, labour, and capital. Capital usually being defined as ‘physical capital’, which includes things like plant, property, equipment and computer hardware.

In reality, there are at least eight factors of production since there are at least eight types of capital.

5. Equilibrium

Economics assumes that markets tend towards equilibrium, a situation in which the economic forces of supply and demand are balanced. However, there is little discussion about how long this process might take.

If a good is perishable, then markets will quickly tend towards equilibrium. Sellers will adjust the price to ensure that inventories can be sold within the time available. Shortages allow sellers to raise prices and still sell all of their inventory within the allotted time. Surpluses require sellers to cut prices in order to offload their goods before they go bad.

However, durable goods and assets could diverge from the market equilibrium for a long period of time.

This could happen if storage costs are low relative to the value of the good. For example, DeBeers has hoarded diamonds for more than 100 years.

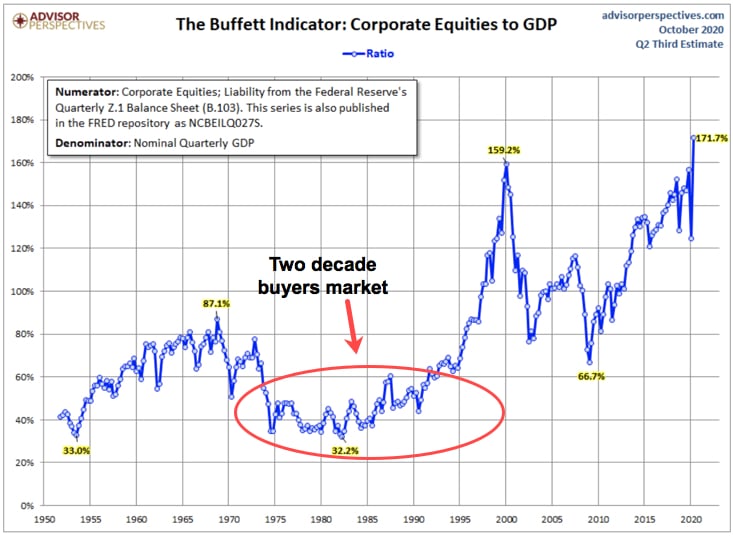

It could also happen if there is a large secondary market or derivatives market. For example, bullion banks like JPMorganChase have suppressed the price of gold for decades by selling naked shorts in the Comex gold futures market. In public stock markets, which are secondary markets for equity securities, prices are influenced by investor sentiment, which can remain bearish for years. John Maynard Keynes famously noted that “markets can remain irrational longer than you can remain solvent.”

6. Comparative Advantage

Economics teaches that specialisation can lead to gains from trade if each country specialises in producing goods for which it has a comparative cost advantage.

In reality, a country is not a monolith. Each country contains many people, cities and regions, each with different factor endowments and thus different comparative cost advantages. Complete specialisation by a country could thus create structural unemployment for certain people, cities and regions within the country.

Even if a country does have a clear comparative advantage, complete specialisation would mean relying on other countries for goods not produced. This could create national security risks, and may overlook other important costs such as transportation costs, shortage costs, and pollution. The COVID-19 pandemic has shown the shortcomings of hyper-specialisation combined with just-in-time supply chains.

Free trade and offshoring production is often promoted by politicians as a law of nature which they are helpless to stop. However, governments have a role to play in shaping the economy by creating a strategic plan and investing to build comparative cost advantages over time. This might be done by investing in basic research, building productive capital, or protecting new industries until they have matured enough to reduce production costs via economies of scale.

In developing trade and industrial policy, countries should consider not only comparative cost advantages and resource endowments but also opportunities offered by fast growing markets and new technology trends.

7. Perfect Competition

Economics describes perfect competition as a market where a large number of fully informed buyers and sellers trade a standardised good, and sellers can easily enter or exit the market. This is held out as the ideal against which other market structures should be compared.

In reality, perfect competition rarely exists and is not so perfect.

Buyers typically have less information than sellers both before and after a transaction takes place. Information asymmetry creates risk, which provides opportunities for existing businesses and entrepreneurs to profit by helping to reduce information gaps or by exploiting them.

Monopoly producers have some power to set prices, but this power is limited by consumer demand and the monopolist’s own cost structure. A monopoly producer that increases consumer demand by investing in branding and product quality may be able to raise prices. However, if consumers become more price sensitive or if production costs decrease (e.g. due to new technology, the experience curve, or economies of scale) then a monopoly producer may have an incentive to lower prices.

Even if a monopoly producer does charge a price that is deemed “too high”, this can create other benefits. Flush with cash, a monopoly producer would have a strong enough balance sheet to invest in improving product quality, developing new products, expanding into new markets, undertaking ambitious moonshot projects, and paying the full cost of cleaning up environmental pollution. High monopoly prices also make it attractive for entrepreneurs to develop substitutes. Today, renewables are having trouble becoming cost competitive with low oil prices. One can only wonder whether this would be the case had Standard Oil not been broken up in 1911.

Finally, variety of products may be more important than variety of producers. Instead of having a large number of producers all producing an identical good, consumers might benefit more from having a choice of different products and the ability to choose the one they most prefer or which best meets their needs.

8. Deadweight loss

Economics defines “deadweight loss” as the loss to society that results when the quantity of a good bought and sold is below the market equilibrium quantity.

In reality, deadweight loss is more of a theoretical concept than an actual loss. For example, a monopoly producer might choose to produce less than would be produced in a perfectly competitive market, and charge a higher price. What actual loss results from this decision? The monopoly producer has voluntarily chosen to produce a certain quantity and so can’t be said to have lost anything. Consumers who choose not to buy at the higher price still have their money, and might gain an equal or greater benefit when they spend it on something else.

9. Economic Rent

Economics defines “economic rent” as the excess benefit that people receive from supplying factors of production: labour, land, and capital. Since economic rents derived from land and capital do not require much if any additional productive activity on the part of the owners, economists view these rents as a form of unearned revenue.

In reality, income earned from land and capital are often returns on prior investment. If we want to encourage entrepreneurial risk taking, then we should view the wealth that successful entrepreneurs accumulate as a reward for prior risk taking, and not formulate economic policies that aim to tax it into oblivion.

If a rentier’s income is large relative to his or her needs, or if the wealth was inherited rather than being earned during a single life time, then this will obviously arouse resentment and tend to be viewed as unfair. It may be unfair that some people have easier lives than others but that doesn’t mean that wealth, by itself, should be viewed as a problem which needs to be solved. Does your own wealth impose a cost on society which would justify confiscation and redistribution by government? No, we didn’t think so.

Concentrations of wealth may even confer a benefit on society. If a society has a large number of rentiers who are able to buy a considerable amount of goods, then this represents an opportunity for businesses and entrepreneurs. A surplus of capital within a country would also tend to reduce the cost on capital, making it possible for entrepreneurs to borrow at reasonable rates and encouraging investment abroad where investment returns may be higher.

Of course, it is possible that concentrations of wealth may lead to concentrations of power, which could be abused to the detriment of a nation and its citizens. However, if that is the case, then the problem economists should be concerned about is abuse of power, not economic rents.

10. Loss Aversion

According to Kahneman & Tversky (1979) “losses loom larger than gains”. Following a loss, a person’s satisfaction tends to decrease twice as much as it would increase from an equivalent gain (Khaneman 2011).

Mainstream economics often views loss aversion as irrational because it leads people to respond more strongly to the threat of loss than to the promise of an equivalent gain, and to act differently depending on whether a transaction is framed as a loss or a gain.

Imagine two scenarios:

Scenario A: You buy a share of stock for $1,000, and the price falls to $950. If you hold the stock for another week, there is a 50% chance that the price will fall to $900 and a 50% chance that the price will increase to $1,000. Should you sell now or wait?

Scenario B: You buy a share of stock for $900, and the price rises to $950. If you hold the stock for another week, there is a 50% chance that the price will fall back to $900 and a 50% chance that the price will rise to $1,000. Should you sell now or wait?

Since the purchase price is a sunk cost that can’t be recovered, mainstream economists argue that the two scenarios are basically equivalent. Since people might be inclined to wait in Scenario A (in the hope of recovering their losses) and sell in Scenario B (in order to lock in a gain) economists view this as irrational. But is it?

While holding on to a losing investment may turn out to be a mistake, people’s relatively strong desire to avoid losses seems to be rational for at least three reasons.

- Investment performance is measured using a geometric rather than an arithmetic average. If you have $1,000 and invest for two years, earning 5% in the first year and losing 5% in the second year, then you will ultimately end up with $997.50 ($1,000 x 1.05 x 0.95). Losses affect total returns more than gains do.

- Investors measure returns relative to their initial investment, not in absolute dollar terms. Selling in Scenario A guarantees a 5% loss whereas selling in Scenario B guarantees a 5.6% gain. It is understandable that traders would not want to lock in a loss. To avoid holding on to losing trades for too long, professional traders follow the ‘2% rule‘, in which they risk no more than 2% of their available capital on any single trade.

- While $50 may be too small an amount to worry about, loss aversion tends to increase as the stakes are raised. This makes sense since big losses carry existential risk. If you enjoy a big gain this may feel nice, but the novelty of eating caviar will quickly wear off. If you suffer a big loss, on the other hand, you may be completely wiped out and never recover.

Image: Pexels

4 replies on “10 Flaws with Mainstream Economics”

In point # 9 “of course concentrations of wealth may lead to concentrations of power which could be abused…..” I’d love to hear a convincing argument that this really is a “could” and not about as close to a certainty as one can get.

Your point is well taken, Joseph.

Interesting that your first and third points for #10 respectively echo Mark Spitznagel and Nassim Nicholas Taleb’s criticisms of modern portfolio theory. I imagine you’re familiar with their writings on the matter?

Hi Leviathan,

Thanks for your comment!

I’m familiar with Nassim Taleb but not Mark Spitznagel. I may have incorporated some ideas from Taleb or others unconsciously. My intention was merely to summarise some of my own learning based on teaching undergrad economics. I hope you found it to be interesting or insightful!