The Porter’s Five Forces framework is used to determine the competitive intensity and attractiveness of an industry

HARVARD Business School professor Michael Porter, in his 1979 book Competitive Strategy, developed the Porter’s Five Forces.

The Porter’s Five Forces framework is used to determine the competitive intensity and attractiveness of an industry. Attractiveness in this context refers to the overall industry profitability. You can use this framework when introducing a new product, expanding into a new market, divesting a product line, acquiring a new business, or assessing the cause of declining sales or profitability.

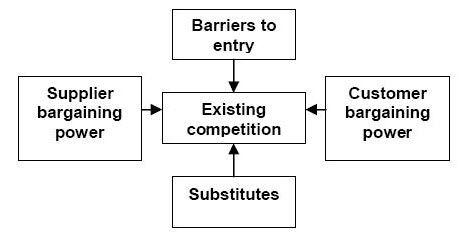

In determining the competitive intensity of an industry, Porter’s Five Forces include three forces from ‘horizontal’ competition (1, 2 and 3), and two forces from ‘vertical’ competition (4 and 5):

- Existing competition: How strong is the rivalry posed by the present competition?

- Barriers to entry: What is the threat posed by new players entering the market?

- Substitutes: What is the threat posed by substitute products and services?

- Supplier bargaining power: How much bargaining power do suppliers have?

- Customer bargaining power: How much bargaining power do customers have?

1. Competition: How strong is the rivalry posed by the present competition?

The intensity of competition in an industry is affected by various factors, including:

- The number of firms in the industry, the more firms the stronger the competition because there are more firms competing for the same customers;

- Slow market growth leads to increased competition because there is only a small number of new customers entering the market each year, firms must compete to win existing customers;

- Where firms have economies of scale, that is they have relatively high fixed costs and low variable costs, the more they produce the lower their per unit costs become. This results in more intense rivalry between firms as they compete to gain market share;

- Where customers have low switching costs, this intensifies competition as firms compete to retain their current customers and steal customers from other firms;

- Low levels of product differentiation between firms leads to increased competition. Where a firm has a strong brand name or a highly differentiated product, this reduces the intensity of competition;

- Diversity of competition (for example, firms from different countries and cultures) reduces the predictability and stability in the market. Uncertainty in the market leads firms to compete more agressively, thereby driving down firm profits in the industry;

- High exit barriers increase competition because firms that might otherwise exit the industry are forced to stay and compete. A common exit barrier is where a firm has highly specialised equipment that it cannot sell or use for any other purpose; and

- An industry shakeout will result in a short period of intense competition. Where a growing market induces a large number of new firms to enter the market, a point is reached where the industry becomes crowded with competitors. When the market growth rate slows and the market becomes overcrowded, a period of intense competition, price wars and company failures ensues.

2. Barriers to entry: What is the threat posed by new players entering the market?

In theory, any firm should be able to enter a market, however, in reality industries often possess characteristics that prevent new players from entering the market (barriers to entry). Barriers to entry reduce the rate of entry of new firms, thus maintaining the level of profits for those firms already in the industry.

Barriers to entry may exist for various reasons, including:

- high capital costs of setting up a business in a particular industry;

- where an industry requires highly specialised equipment, potential entrants may be reluctant to commit to acquiring specialised assets that cannot be sold or converted into other uses if the venture fails;

- lack of the proprietary technology or patents that are needed to become a player in the industry;

- extensive scale and branding of existing competitors may prevent potential entrants from gaining market share and hence deter entry into the market;

- government regulations: Government may regulate to prevent new firms from entering an industry. It might do this because of the existence of a natural monopoly. A natural monopoly is an industry where one firm is able to produce the desired output at a lower social cost than could be achieved by two or more firms (social costs being the sum of private and external costs). Natural monopolies exist because of the existence of economies of scale, and examples include railways, water services, and electricity; and

- Individual firms may have economies of scale. The existence of such economies of scale creates a barrier to entry because an existing firm can produce at a much lower cost per unit than a new firm.

3. Substitutes: What is the threat posed by substitute products and services?

Economics defines substitute goods as goods for which an increase in demand for one leads to a fall in demand for the other. In the Porter’s Five Forces framework, a reference to a substitute good refers to a good in another industry. For example, natural gas is a substitute for petroleum.

Good A and good B are substitutes if they can be used in place of one another (at least in some circumstances). The existence of close substitutes constrains the ability of a firm to raise prices and, as the number of substitutes increase, the quantity demanded will become more and more sensitive to changes in the price level (i.e. price elasticity of demand for the product increases).

The threat posed by substitute goods is affected by various factors, including:

- the cost to customers of switching to a substitute product or service (switching costs). For example, the cost of switching between the Windows operating system and Apple operating system might be prohibitive because computer programs and accessories are built to work with one operating system or the other;

- buyer propensity to substitute;

- relative price-performance of substitutes; and

- perceived level of product differentiation.

4. Supplier bargaining power: How much bargaining power do suppliers have?

Suppliers are providers of the inputs to the industry, for example, labour and raw materials. Factors that will effect the bargaining power of a supplier include:

- The number of possible suppliers and the strength of competition between suppliers;

- Whether suppliers produce homogenous or differentiated products;

- The importance of sales volume to the supplier;

- The cost to the firm of changing suppliers (switching cost);

- The presence of substitute inputs; and

- Vertical integration of the supplier or threat to become vertically integrated. Vertical integration is the degree to which a firm owns its upstream suppliers and its downstream buyers. For example, a car manufacturer may also own a tyre manufacturer.

5. Customer bargaining power: How much bargaining power do customers have?

Customers are the purchasers of the goods or services produced by the company. Factors that will effect the bargaining power of a customer include:

- The volume of goods or services purchased. If the customer purchases a significant proportion of output, then they will have a significant amount of bargaining power;

- The number of customers. The fewer customers there are, the more bargaining power they will have to negotiate price. For example, in America the market for defence equipment is a monopsony, a market in which there are many suppliers and only one buyer. As such, the Department of Defence has strong bargaining power to negotiate the terms of supply contracts;

- Brand name strength. A product that has a stronger brand name will be able to be sold for a higher price in the market;

- Products differentiation. A firm that produces a product or service that is unique in some way will have more bargaining power and will be able to charge a higher price in the market; and

- The availability of substitutes.

For more information on consulting concepts and frameworks, please download “The Little Blue Consulting Handbook“.

13 replies on “Porter’s Five Forces Analysis”

Tom, I’m working on a project with a non-profit organization without a charitable status. I am faced with an obstacle of applying Porter’s 5 Forces Model to the NGO industry.

From my interpretation of the model, it is only suited for commercialized organizations. I am having a hard time determining the Barriers to Entry and Bargaining Power of Suppliers (as there are no suppliers, at least none that i can think of).

Any idea how i can apply this model to NGO’s?

Any help would be appreciated.

Thanks

tom,

even i am working on a project with an NGO in india. i am also facing a problem in analyzing these 5 forces in an NGO.

could you please suggest me regarding how do i go about in applying this model in an NGO.

thank you

Samaira,

You could use the Porter’s Five Forces for an NGO, but as always, the usefulness depends on what the non-profit does. This is true of for-profit businesses as well. Many non-profits operate businesses – like fair trade coffee suppliers and if they were analysing whether to enter a new market, then you could use Porter’s 5 Forces. Also, a microfinance business could use P5 forces to assess a market. Say, for example, an international NGO was deciding on whether to start a microfinance operation in Bangladesh (a highly saturated microfinance market with low barriers to entry) or China (a nearly empty microfinance market, which has significant demand but very high barriers to entry) – they could use P5 to assess them.

Hope that helps!

Tom

Dear Tom,

As the above mentioned, non-profitable charity organization is not suitable to do 5P force, so, how abt SWOT? This is anlaysis of internal. I m trying to do 5P force of my non-profitable charity organization. But the problem is substitutes and buyers. Coz, nowadays many peoples wanna give helping hands such as they provide money, products and services. those are substitutes. But actually, buyers can be everyone who need help. So, could u give adv and suggest which anlaysis is sutiable to anlaysis non-profitable charity organization? Thank you.

Awaiting for yr prompt reply.

Janis

Dear Janis,

Thank you for your kind message.

The usefulness of the framework depends on what kind of decision you are trying to make. I am not clear what your objective is, so I will just give you an overview of your options.

If you are trying to decide whether to enter into a new market to supply charitable goods or services then you can use the P5 model. The P5 model tells you how attractive the market is, and you can look at competition (how many other charties there are), barriers to entry (how difficult it is to enter that market), and substitutes (how different is your offering to that of other charities). Looking at customers and suppliers is a little different because you are not running a for-profit business. Be creative and adapt the framework. You could think of customers as donors, and suppliers as the people that you help.

SWOT analysis is used to evaluate an objective. It could be used to think about entering a new market, but is useful for thinking other objectives as well. In this sense it is a much broader framework. There is a variation of the SWOT analysis called SCORE, which I understand may be more widely used in the non-profit world.

Promptly yours,

Tom

PS – this is not intended to be a substitute for reading and understanding this post, and one of SWOT analyis.

Dear Tom,

My objective is “some donors change their attitudes of donation to us directly instead of they donate directly to others”. What do u think???

Janis

Dear Janis,

It sounds like you may benefit from using the 4P Marketing Framework.

I’d be interested in hearing other people’s thoughts on this.

Cheers,

Tom

[…] first is industry attractiveness, which is determined in any industry by the five competitive forces: the threat of entry by new competitors, the threat of substitutes, the bargaining power of buyers, […]

[…] Case interviews can be stressful. There are a variety of cases that target specific topics such as market sizing, profitability, mergers and acquisitions, market analysis, brain teasers, and consulting math. Moreover, there are a variety of frameworks that interviewees can use such as the profitability framework, 4Ps, market entry, and Porter’s Five Forces. […]

[…] company specific? Focus on key trends in the industry by employing standard frameworks like PEST or Porter’s Five Forces and highlighting financial performance. Include graphs, charts, and quotes in order to […]

[…] Case interviews can be stressful. There are a variety of cases that target specific topics such as market sizing, profitability, mergers and acquisitions, market analysis, brain teasers, and consulting math. Moreover, there are a variety of frameworks that interviewees can use such as the profitability framework, 4Ps, market entry, and Porter’s Five Forces. […]

[…] Case interviews can be stressful. There are a variety of cases that target specific topics such as market sizing, profitability, mergers and acquisitions, market analysis, brain teasers, and consulting math. Moreover, there are a variety of frameworks that interviewees can use such as the profitability framework, 4Ps, market entry, and Porter’s Five Forces. […]

how market forces impact on vertical integration in supply chains