Loss aversion can lead people to favour the status quo, and so clever marketing is sometimes needed to convince people to buy new products

LOSS AVERSION can lead people to favour the status quo.

How so?

Well, when a consumer considers replacing a good, the presence of loss aversion can lead her to experience more pain in giving up the existing good than she feels joy in acquiring a comparable new one. And so, she does nothing.

While this preference for stability over change can help consumers conserve their money (and we believe that living within ones means is generally a good thing, despite what Paul Krugman will tell you), this penchant for the status quo does not help marketers, entrepreneurs and business leaders persuade consumers to try new products and part with their hard earned cash.

This is not a new problem, but it remains an issue nonetheless.

Below we highlight 6 methods that you can use to overcome loss aversion and encourage consumers to buy new products.

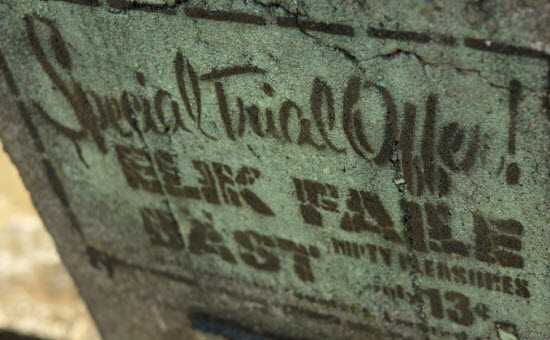

1. Trial Offers & Money Back Guarantees

Trial offers and money-back guarantees are two of the oldest tricks in the marketing playbook. But why do they work?

Due to the role played by loss aversion, when a customer loses a good they generally sacrifice more enjoyment than they gained from acquiring it in the first place.

Trial offers are effective because although a customer may not have been willing to pay the market price to try a product, they may be willing to pay the market price to avoid losing the product when the trial period expires.

Similarly, money back guarantees are effective since, once a good is in a customer’s possession, the payment that she will demand in exchange for giving up the good will tend to be higher than what she originally paid for it.

2. Just Try It On

If you go to buy a suit, the salesperson will probably invite you to try it on.

By doing so, you will start to form an attachment to the product and, due to the role played by loss aversion, the price at which you will be willing to walk away from the product will be slightly higher than before.

3. Trade Ins

People buy goods to enjoy them.

But once the new goods are in hand, people can be reluctant to replace them.

The presence of loss aversion means that people place more weight on losses than commensurate gains, and so can often require a higher price to part with a good than they would be willing to pay to acquire a comparable new one.

While people may have a preference for stability over change, this inclination has been shown to break down where a new good is a close substitute for the old one. And so, if marketers can show that a new good offers all of the benefits of the old good, then people will be much more willing to upgrade since they can part with the old good without losing any benefits.

4. Deferred Payment Plans

By allowing customers to delay payment until after consumption has commenced, you can change the consumption decision from “do I need this?” to “can I do without it?”

5. Framing the Purchase Options

Marketers can influence a purchase decision, even without concealing information, by merely framing the options in a particular way.

For example, would you rather get a 2% discount, or avoid a 2% surcharge?

Lobbyists for the credit card industry worked hard to frame the price difference between cash and credit purchases as a “cash discount” rather than a “credit card surcharge”. The term “cash discount” frames the price difference as a gain by implicitly defining the higher price as normal. And the term “credit card surcharge” frames the price difference as a loss by implicitly defining the lower price as normal.

Since losses have more emotional impact than comparable gains, you are much more likely to forego a 2% discount than to accept a 2% surcharge. And so, by the clever use of framing, consumers have been encouraged to spend on credit.

6. Framing the Expense

People often have a budget and will distinguish between within-budget spending, which they do not think of as a loss, and unbudgeted spending, which provokes loss aversion.

Reader Sally McKenzie made a good point in her comment on the previous post saying, “I think people have intentions for their money. I’m currently travelling on a shoe string budget in Eastern Europe, and it really hurts me to spend money if it makes me exceed my daily budget. Must save precious resources for Croatia!”

Marketers can try to avoid the loss aversion connected with unbudgeted spending by framing a purchase as being within the customer’s existing budget.

For example, marketers might target cost-conscious consumers by describing a product as a “sound investment” which “holds its value well”, and his might be an effective pitch for durable goods like cars or furniture.

Another way to frame spending would be to provide customers with a trial offer. The trial period can give a customer a chance to think about how she might fit the new product into her existing budget. And in this way, the trial offer can help to transform the new purchase into a budgeted expense.

2 replies on “6 Ways to Overcome Loss Aversion”

Hey! You mentioned me! That’s so great! xx

Happy to mention you, Sally. We thought your comment was very insightful.