Acronym: an abbreviation formed from the initial letters of other words and pronounced as a word. For example, “PEST” stands for Political, Economic, Social, and Technological, which are the four factors for a business to consider when scanning the business environment (see PEST Analysis).

Asset (accounting definition): an economic resource that a company uses to operate its business, e.g. cash, inventories, and equipment.

Asset (investing definition): something that puts money in your pocket every month (i.e. your house and your car are not assets). For more information, read the article: What is an asset? What does it mean to be wealthy?.

Barriers to entry: the obstacles that must be overcome and the costs that must be paid by a new market entrant but not by firms already in the industry. For more information, read the article: Barriers to entry.

Black Swan: an event that is unpredictable, has significant consequences, and is (or at least appears to be) retrospectively explainable. The term “Black Swan” was coined by Nassim Nicholas Taleb in his book The Black Swan.

Brand: what people say about you (or your organisation) when you’re not in the room.

Bund: the German government’s federal bond, similar to Treasury bonds in the U.S.

Business Mutualism: an association between two or more separate enterprises, or fields of activity, where (1) each enterprise benefits the other, and (2) collective discoveries emerge beyond those of any single field. For more information, read the article: Business Mutualism.

CFA: stands for “Chartered Financial Aanalyst”. For more information, visit the CFA Institute.

Coase theorem: if trade in an externality is possible and there are no transaction costs, bargaining will lead to an efficient outcome regardless of the initial allocation of property rights. In practice, obstacles to bargaining or poorly defined property rights can prevent Coasian bargaining.

Collectively Exhaustive: where information is being grouped into categories, all categories taken together are said to be “collectively exhaustive” if all relevant information falls into one or more categories.

Comparative Advantage: a country has a comparative advantage in producing a good if it can produce that good at a lower opportunity cost than any other country.

Complimentary goods: any goods for which an increase in demand for one leads to a increase in demand for the other. Examples of complimentary goods might include printers and ink cartridges, DVD players and DVDs, and Microsoft Windows and PCs.

Confirmation bias: a tendency of people to favour information that confirms their existing beliefs.

Cost benefit analysis: an analysis framework that involves weighing up the total expected costs and benefits of one course of action against another. For more information, read the article: Analysis framework: understanding the cost benefit analysis.

Credit default swap (CDS): a form of insurance policy which obliges the seller of the CDS to compensate the buyer in the event of loan default. In the event of default, the buyer of the CDS would normally receive money and the seller of the CDS would receive the defaulted loan (and the right to recover amounts outstanding under the loan).

Cross Rate: the exchange rate between two currencies inferred from each currency’s exchange rate with a third currency.

Debt: a form of financial leverage which can be used to increase your ability to consume or invest.

Discouraged worker: a person who does not have a job and is available to work but who has stopped actively looking for work. This may happen because an unemployed person:

- becomes discouraged due to previous unsuccessful attempts to obtain work;

- believes (reasonably or not) that there are no jobs available in their industry or location;

- lacks the skills needed for the jobs which are available, either because they never had the required skills or because their skills have eroded due to a long period of unemployment;

- is discriminated against by prospective employers for some reason beyond their control (e.g. age, race, gender); or

- becomes addicted to Twinkies and day time television. This one sounds like a joke, but it is conceivable that after a period of prolonged unemployment a person who previously had an aversion to receiving welfare payments could become welfare dependent.

Diseconomies of scale: a situation where the average cost of production increases as output increases. For more information, read the article: Economies of scale.

Disruptive innovation: a process by which a product or service initially takes root in simple applications at the bottom of a market and then consistently moves ‘up market’, eventually displacing established competitors.

Diversification: see “Horizontal diversification”, “Lateral diversification”, and “Vertical integration”.

Economic indicator: any economic statistic (e.g. the unemployment rate, GDP, or the inflation rate), which indicates the current strength of the economy and/or the future expected performance of the economy. For more information, read the article: Economic recession 2008: measuring the strength of the economy.

Economies of scale: a situation where the average cost of producing one unit of a good or service decreases as the quantity of output increases. For more information, read the article: Economies of scale.

Elevator pitch: a high-level overview of whatever it is that you are selling and is designed to just get the conversation started. For more information, read the articles: The Elevator Pitch, and 12 Tips for Creating an Effective Pitch.

Equity: the net worth of a company equal to Assets minus Liabilities. Equity holders are the owners of the business.

Expenses: costs incurred by a business over a specified period of time to generate the revenues earned during the same period. For more information, read the article Understanding Financial Statements 101.

Externality: a cost or benefit which is incurred by a person who did not agree to the activity which caused the cost or benefit. Externalities that confer a benefit are referred to as “positive externalities”; externalities that impose a cost are referred to as “negative externalities”. When externalities exist, the market price of the good or service will not reflect the full social cost or benefit.

Fiscal Policy: government policy as it relates to government spending and taxes.

Fixed cost: a cost that do not vary with the quantity of output produced. It is important to understand that fixed costs are fixed only in the short term. In the long run nearly all costs are variable: a company can renegotiate its supply contracts or move its factories to a country with lower costs of production.

Greenspan Put: the monetary policy of Alan Greenspan and the Federal Reserve from the late 1980’s to the mid-2000’s, which involved significantly lowering interest rates in the wake each financial crisis.

Homogenous product: any good or service for which buyers perceive no difference between the products offered by different suppliers. For example, wheat, corn and oil.

Horizontal diversification: a situation where a company adds new products, often unrelated to its existing products, that may appeal to existing customers. This strategy may increase the company’s dependence on certain market segments.

Industrial organisation: Industrial organisation is a field in economics which examines the structure of firms and markets.

Inflation: an increase in the overall price level over a period of time.

Investment banking: a profession that involves raising money to allow a company to grow its business. This money might be raised by selling securities (stocks and bonds).

Investment operation: an operation which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative (Ben Graham, The Intelligent Investor).

Joint production: production where the production process for two or more different goods is connected. Producing the goods separately would result in increased costs. Joint production may occur naturally: for example, a chicken farm produces both chicken wings and chicken breasts. Joint production may also be used because it provides economies of scope.

Lateral diversification: a situation where a company moves beyond the confines of the industry to which it belongs. Sometimes referred to as “conglomerate diversification”.

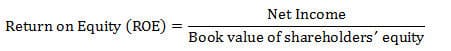

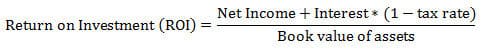

Leverage (investment definition): the use of borrowed capital to partially or fully fund an investment. Leverage is used when an investor expects the return on investment (ROI) to be greater than the cost of debt, in which case the investor’s return on equity (ROE) will be greater than the ROI. You could say the returns are leveraged.

Liability (accounting definition): the debt of a company, a claim that creditors have on the company’s resources.

Liquidity trap: a situation where interest rates are zero (or near zero) and a central bank is no longer able to stimulate the economy by controlling short term interest rates. In 2008, the Federal Reserve was faced with a liquidity trap and employed quantitative easing to stimulate the economy.

Loss aversion: refers to a commonly observed behavioural trait whereby people would prefer to avoid a loss than to make a commensurate gain. For more information, read the article: Loss Aversion.

Ludic Fallacy: a term coined by Nassim Nicholas Taleb in The Black Swan. The term refers to the misuse of games to model real-life situations. Taleb explains the fallacy as “basing studies of chance on the narrow world of games and dice.”

Madoff Scheme: see Ponzi Scheme.

Management consulting (Tom’s definition): a profession that aims to assist management by (a) providing expert knowledge, (b) facilitating the examination of business problems, (c) implementing solutions, and (d) supporting organisational change. For more information, read the article: What is management consulting?.

Management consulting (Institute of Management Consultants’ definition): “The provision to management of objective advice and assistance relating to the strategy, structure, management and operations of an organisation in pursuit of its long-term purposes and objectives. Such assistance may include the identification of options with recommendations; the provision of an additional resource and/or the implementation of solutions.”

MECE: mutually exclusive, collectively exhaustive.

MECE analysis: the idea that, when analysing a business problem, issues should be divided into groups so that each grouping is separate and distinct (mutually exclusive), and all groups taken together should comprehensively represent all of the issues related to the problem at hand (collectively exhaustive). For more information, read the article: MECE Framework.

Mnemonic: a system or technique that is designed to aid the memory.

Monopoly: a situation where a market has only one supplier for a particular good or service. Monopolies are characterised by a lack of competition and a lack of viable substitutes.

Moral Hazard: any situation where a person or organisation is not fully responsible for the consequences of its actions. As a result, the person or organisation may take greater risks than it otherwise would because it is not responsible for paying the full cost if things go badly. For more information, read the article: Moral Hazard.

Mortgage Securitisation: a process which involves three steps:

- purchasing mortgages from banks and mortgage brokers;

- grouping these mortgages together into large pools; and then

- selling “shares” in these mortgage pools to investors.

Neologism: a newly coined word or phrase that might be in the process of entering common usage, but has not yet been accepted into mainstream language. E.g. “business mutualism”.

Network effects: the situation whereby a product or service becomes more valuable as more people use it (also known as network externalities). One example is eBay; as more buyers use the online auction site it becomes more valuable to each seller, and as more sellers use the site it becomes more valuable to each buyer.

NINJA Loan: any loan made where the borrower has No Income, No Job, and No Assets.

Nominal value: a value expressed in dollar terms. For example, if a Big Mac costs $3 this year and $6 next year, then we would say that the nominal price of the BigMac has doubled.

NPV (net present value): The net present value of an investment is the present value of the series of cash flows generated by the investment minus the cost of the initial investment. For more information, read the article: Analysis Framework: Net Present Value.

Numéraire: an economic term which refers to “the unit of account”. In French, the term means “money”, “coinage” or “face value”. A country’s currency normally acts as the numéraire and is used to measure the worth of other goods and services within the country. In the absence of currency, you could define a “numéraire good” (e.g. salt, copper, gold) to have a fixed price of 1; the worth of other goods and services can then be measured relative to the numéraire good.

Oligopoly: a situation where a market is dominated by a small number of suppliers for a particular good or service. Oligopolies are characterised by a lack of competition and a lack of viable substitutes. Each firm in an oligopoly must take into account the likely actions and reactions of other firms when developing its strategic plan.

Opportunity cost: the opportunity cost of an item is what must be given up to obtain that item.

Option: a derivative financial instrument which grants its owner the right, but not the obligation, to purchase or sell an underlying asset at a pre-established price for a specified period of time.

Organic growth: growth that a company can achieve by increasing output and sales. This excludes growth achieved as a result of mergers and acquisitions since these profits are not generated internally (e.g. if Facebook achieves growth as a result of its purchase of Whatsapp then this would not be considered organic growth).

Overconfidence bias: refers to a behavioural trait whereby a person’s confidence in their opinions is invariably higher than the accuracy of their opinions.

Pareto efficient: an economic allocation is said to be “Pareto efficient” if no person can be made better off without making at least one person worse off. Pareto efficiency does not imply that an economic allocation is fair or equitable.

Perspicacity: a keenness of perception and the ability to draw sound conclusions; to be insightful, shrewd, and discerning.

Ponzi Scheme: any kind of fraudulent investment operation that pays returns to investors from their own money or money paid by subsequent investors rather than from any profits earned.

Porter’s Five Forces: a framework used to determine the competitive intensity and attractiveness of an industry, it considers five forces affecting the competitive pressure exerted on a business: existing competition, barriers to entry, substitutes, customer bargaining power, and supplier bargaining power. For more information, read the article: Analysis framework: Porter’s Five Forces.

Price taker: a firm that can change its production and sales of a product without significantly affecting the market price.

Product differentiation: the process of describing the differences between a good or service in order to demonstrate the unique aspects of your good or service and create an impression of value in the mind of the consumer.

Public good: a good which is non-rival and non-excludable. Non-rivalry means that consumption of the good by one individual does not reduce availability of the good for other to consume; and non-excludability means that no one can be excluded from using the good. In the real world, there may be no goods which are absolutely non-rival and non-excludable.

Real value: a value adjusted for inflation or deflation. For example, if a Big Mac costs $3 this year and $6 next year, then assuming inflation is 100% the real price of the BigMac has not changed.

Recession: broadly speaking, a recession is a period of slow or negative economic growth, usually accompanied by rising unemployment. Economists have other more precise definitions of a recession, the easiest of which to understand is “two consecutive quarters of falling GDP”. For more information, read the article: Economic recession 2008: measuring the strength of the economy. Alternatively, visit the Economist A-Z.

Remarkable: something that is worth people making a remark about. Are you doing something remarkable?

Replacement value: an estimate of how much it would cost to build equivalent resources or capabilities from scratch.

Revenue: income generated from trading or, for example, selling off a piece of the business or a piece of equipment. Revenue is recorded when the sale is made as opposed to when the cash is received. For more information, read the article: Understanding Financial Statements 101.

Résumé: a document which summarises your background and accompanies your cover letter as part of your job application. For more information, read the article: Creating a winning résumé.

Serendipity: a happy and unexpected event (or discovery) that occurs by accident.

Seven S framework: a diagnostic tool that provides a guide for organisational change, it describes seven factors which together determine the way in which an organisation operates: shared values, staff, skills, style, strategy, structure, and systems. For more information, read the article: Analysis framework: McKinsey’s 7-S Framework.

SMART Goals: any goal which is Specific, Measureable, Achievable, Relevant, and Time-Bound. For more information, read the article: Set SMART Goals.

Spillover: externalities that result from economic activity and affect people who are not directly involved in the activity. Spillover can be positive or negative. Pollution that leaks out of a manufacturing plant and into a local river would have a negative spillover effect on local fishermen. The beauty of the buildings in Oxford would have a positive spillover effect on locals and tourists.

Substitute goods: any goods for which an increase in demand for one leads to a fall in demand for the other. Substitute goods represent a form of indirect competition. Examples of substitute goods might include Coca-Cola and Pepsi or Vegemite and Nutella.

Sunk cost: an expenditure that has already been paid and which cannot be recovered.

Switching costs: any costs that a consumer incurs (e.g. money, time, effort) as a result of changing suppliers, brands or products.

SWOT: strengths, weaknesses, opportunities and threats.

SWOT analysis: a strategic planning tool used to evaluate the strengths (S), weaknesses (W), opportunities (O), and threats (T) involved in a business venture. It involves specifying the objective of the business venture and identifying the factors that are expected to help or hinder the achievement of that objective. For more information, read the article: Analysis framework: SWOT analysis.

TARP: the US$700 billion Troubled Asset Relief Program created by the US government in 2008 in the wake of the sub-prime mortgage crisis.

Underemployment: a situation where a person’s capacity to work is not fully utilised. This may occur for three reasons: (1) over-qualification, (2) involuntary part-time work, and/or (2) over-staffing.

Value Chain Analysis: the process of separating a business operation into a series of value-generating activities in order to understand the activities that provide the business with a competitive advantage. For more information, read the article: Analysis framework: Value Chain Analysis

Variable cost: a cost that varies with the quantity of output produced. When making decisions in the short run, variable costs are the only costs that should be considered because, in the short term, a company cannot change its fixed costs.

Vertical integration: refers to a form of diversification where a firm expands its business to different points in the supply chain. For example taking over a supplier (backwards vertical integration) or taking over a customer (forwards vertical integration).

Virtue-signal: Publicly express opinions on an issue with the aim of demonstrating one’s moral superiority but without incurring any personal cost or taking any action to address the issue.

Backward vertical integration: A company engages in backward vertical integration when it purchases one or more suppliers that produce inputs that the company uses to produce final goods or services. For example, a car company might own a tire company, a glass company, or an engine manufacturer. Benefits of backward vertical integration include (1) creating stable supply, and (2) ensuring a consistent quality of inputs.

Walmart Effect: A situation where a single customer becomes the major purchaser of goods and services giving it substantial control of the market.

Wealth:

- Real wealth is discretionary time; money is merely the fuel (attributed to Alan Weiss).

- A measure of a person’s ability to survive so many number of days forward into the future if they were to stop working today (attributed to Robert Kiyosaki). For more information, read the article: What is an asset? What does it mean to be wealthy?.

One reply on “Definitions”

[…] where connection and collaboration make products more valuable as more people use them (see network externalities). Entrepreneur and venture capitalist Marc Andreessen famously noted that “software is […]